Most of us have had some financial emergency in our lives. That could be related to health, education, or even mortgage.

We needed some money urgently to pay off our dues, but at the last moment, that cash was hard to come by. Had we made some planned investments, we wouldn’t have gotten into that crisis at all.

In this article, we look at some financing hacks that can be used in financial emergencies. We are looking at some stable revenue streams; those that assure some returns to the investor.

Table of Contents

1. Fixed Income Investments

These investments fetch regular payments in the form of interest. These investments are generally made in banks backed by the Australian government.

These investments fetch regular payments in the form of interest. These investments are generally made in banks backed by the Australian government.

Let’s say you park 1000 AUD in one of the Australian banks for five years. The bank promises to pay you a 10% simple interest every year until the 5th year. 10% of 1000 is 100 every year, and so, you receive 100 AUD. At the end of the last year, you earn 100 AUD for every year, plus your principal amount of 1000 AUD.

Therefore, in 5 years, you received 500 AUD in all. Since you are assured of this amount, you can make the necessary expenditure toward your house, education, health, or any other emergency. The problem in this kind of investment is it does not take into account inflation. If at the end of the 5th year, the value of AUD declined by 5%, effectively you are getting 500-5%. So you are getting lesser money. However, the fixed income stream more than makes up for this inflation.

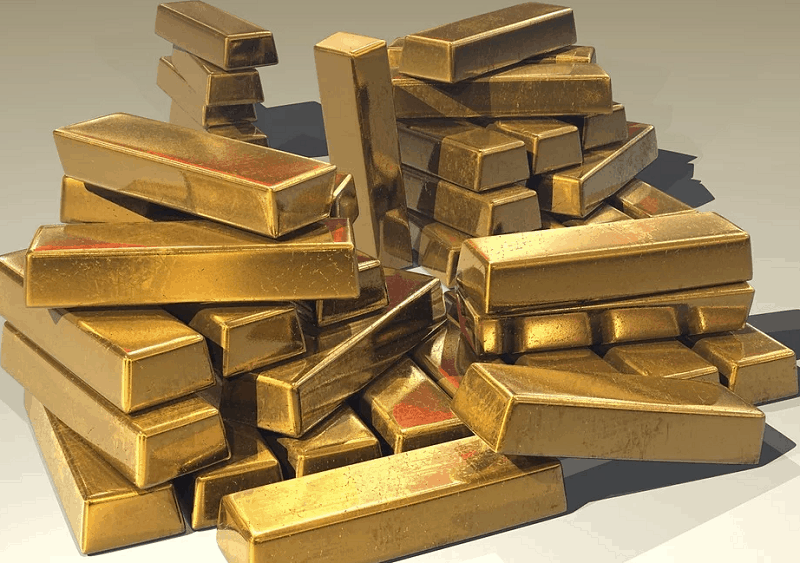

2. Bullion

Another great way to raise funds during an emergency is investments in bullion markets. The term ‘bullion’ refers to gold and silver bars, but currently, you can buy these metals in small quantities too. In times of need, you can sell your bullion at attractive prices and raise funds. Since the price of gold is more stable than returns from other investments, you’d get decent returns.

There are two reasons for investing in gold. One, it offsets any sudden plunge in your asset value. Market forces are always volatile and can deplete your asset value in no time. Gold offsets this sudden loss. So, in case you are left with little or no money, you can dip into your gold reserves. Buying and selling gold is quite an easy affair.

The other reason why you should buy gold is that it acts as a cushion to a falling U.S dollar. The latter is the second most stable commodity in the world after the gold, but even it can fall in value. A declining dollar can affect your other investments.

3. Savings Deposits

Perhaps, one of the safest and most stable investments is the humble savings deposit. Most investors deposit their spare funds (monthly salary- monthly spending) in banks.

Perhaps, one of the safest and most stable investments is the humble savings deposit. Most investors deposit their spare funds (monthly salary- monthly spending) in banks.

In return, they receive annual or semi-annual interest. The rate of interest is minimal, but you can withdraw your deposits at any time. Therefore, savings deposits have high liquidity.

4. Stocks

Many people believe that stocks are volatile, but this is an untrue statement.

Shares of blue-chip companies deliver stable returns over a period. Blue-chip companies are those that are managed well and exceed shareholder expectations. If you are planning to buy the stock of a good company, you may like to contact a stockbroker.

Please note that like savings instruments, stocks and shares are highly liquid too.

It’s essential that you use portfolio tracking software to keep track of your investments. You can monitor the return on your investments and assess if you should buy more or sell.

If the market is bullish, it’s a good idea to avail of margin loans against shares and make some further investments. However, you should sell your shares if they are not delivering good returns.

Well said.Saving money can help us to become financially more secure and provide a safety net in case of an emergency.

I don’t know too much about stocks to comment about it, except that my brother swears by it. But savings deposits are reliable and like Erik said, you can withdraw your money at any time, and accrue interest at the same time. The more money you put in, the more interest you build up.

Hi erik,

I don’t have much knowledge on other things but savings deposits are something that comes hands in terms of emergency and are a most reliable and secured investment of money.

Saving money in this point of time due to the Covid-19 pandemic is really hard. But learnt a lesson to save money for uncertain future

Budgeting in this covid 19 pandemic situation is an unavoidable one. Savings always gives us a safe and comfortable feeling