If you are someone who has taken a massive leap of faith and decided to start their own business, chances are that your resources are limited; monetary and human resources. And to kickstart the company, you need to have some saving money (or resources) tips. That doesn’t mean that you will illegally reduce your income tax or pay your employees minimum wages.

There are some tips that will help you cut down on expenses when you first start your business.

Here are some of them:

Table of Contents

1. Don’t focus on scaling your product/service too soon

At the beginning of the launch of your new product/service, people aren’t still sure whether they trust it, whether your brand focuses on quality, or if it is even a reliable product. To position your product/service as a high-quality one in the minds of potential customers in the beginning, it is smart to try to perfect the product/service as much as possible before focusing on scaling.

Startup owners sometimes make the mistake of trying to hire as many employees as their budget allows them in order to produce more, but that’s not the best way to do it. Stick with your current employees, and later on, they will have so much loyalty towards the business because both of them grew together.

2. Don’t shy away from asking for discounts

The best way to get discounts is to ask for them. When you start your own business, it is very important that keep an eye on discounts, and frankly speaking, no one wants to give discounts, but if you make it clear that you won’t use their services without a discount, most of the time they wouldn’t risk losing a customer.

Therefore, ask for discounts every time you can. Oftentimes, vendors and suppliers set the price according to this because they know that businesses, especially startups, ask for discounts. Even if they refuse to give you the discount, you can always go for another supplier or vendor. You can save a lot by doing this on suppliers, software, and much more.

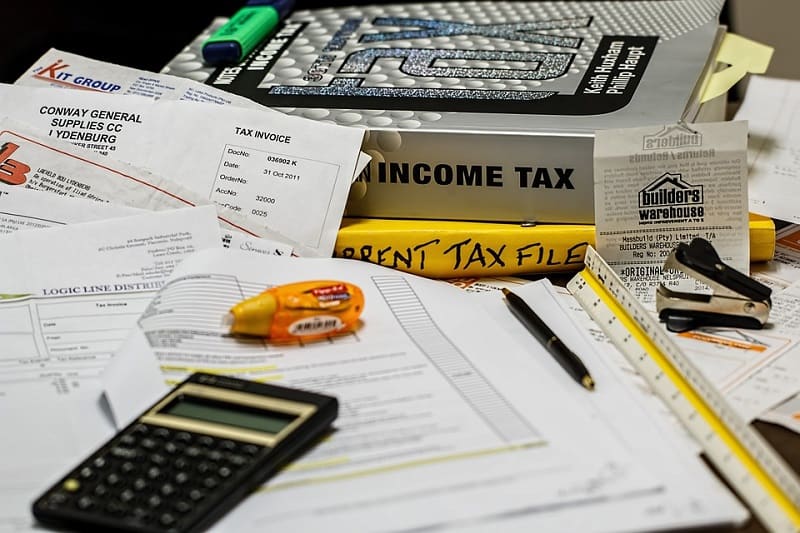

3. Hire a professional accountant

As a new business owner, you might think or have heard from many people that you should not be spending on professional services like accounting, and that is something you should only consider when your firm is big enough. However, hiring an accountant is something all businesses should consider at any point in their growth.

Depending on the country you are operating your business in, income taxes can be a back-breaking expense for businesses. According to an accounting and CPA firm in Northern VA, Professional accountants and CPAs will not only help in reducing risk, complying with the law, managing growth, and many other value-adding services, but they will also help you in saving money by managing your expenses and finding ways to cut down on income taxes.

That is important because as a business owner, the majority of your business decisions are based on your financial situation. Hence, you need an expert who can guide you, save money, and give your professional advice. VAT returns are businesses’ nightmare; not only because you need to pay a lot, but you need to have foolproof accounting records that are audited. You could risk getting a huge fine if something is wrong, or having your finances investigated. As an entrepreneur, you don’t have the money or the time for that.

So, although it might be intriguing to not hire a professional accountant and juggle the job yourself, it is better that you don’t because if you take one fall, you might not be able to recover and you might miss a lot of tax-saving potentials.

4. Consider outsourcing

Hiring full-time employees is not only expensive but very time-consuming. It takes time to find the right talent, train them, and if you don’t have the time to do so, you will spend a lot hiring someone who has plenty of experience and doesn’t need a lot of training time. That is exactly when outsourcing on freelance platforms comes in handy.

Platforms like Fiverr or Upwork make it easier for businesses to hire people right away without having to hire employees, especially if it’s a one-time job or something you don’t need very often. Because these platforms are very competitive, it is not hard to find someone good within your budget. Freelancing is not as it used to be. In fact, there are many ways to know if the freelancer is qualified or not.

#1 is such a biggie but few entrepreneurs speak about it. Allow scale to unfold organically on the cheap to not only save money but to allow a group of loyal followers to make money for you passively. Few have the vision, discipline, patience and willingness to work for free for a bit to let loyal fans become customers, clients and to let these folks build business through their word of mouth marketing. Costs zero dollars too. Learn the art of serving and surrender to the process to grow business by building strong enough bonds to where people grow your business for you, en masse.

Fabulous blog post.

Ryan

Hiring an accountant is one of the smartest things a new business owner can do. Most business owners are great at what they do, not at managing their finances. But this is what accountants do all day everyday. And they are especially helpful during tax time when it’s time to produce receipts, create write-offs, and sort deposits from purchases.

Hello,

One of the best decisions a startup business owner can make is to hire an accountant. The majority of business owners excel at what they do but struggle with money management. But accountants work like this all day, every day. And when it comes time to make receipts, create write-offs, and separate deposits from purchases during tax season, they are very useful.

Hello,

The best thing a new business owner can do is hire an accountant. Most business owners excel in what they do, but not always in financial management. However, accountants work like this all day long. They are also extremely useful when it comes to filing taxes because they make it easier to gather receipts, establish write-offs, and separate deposits from purchases.