Prudent entrepreneurs find a way to follow good business tax practices. It ensures that their businesses remain well positioned to meet tax obligations. Remember, tax penalties are punitive and could cost your business a lot of money. It means that you need to organize yourself to meet tax deadlines on time to avoid penalties.

Here are basic tips from Sandhurst Consultancy to help you meet tax obligations on time.

Table of Contents

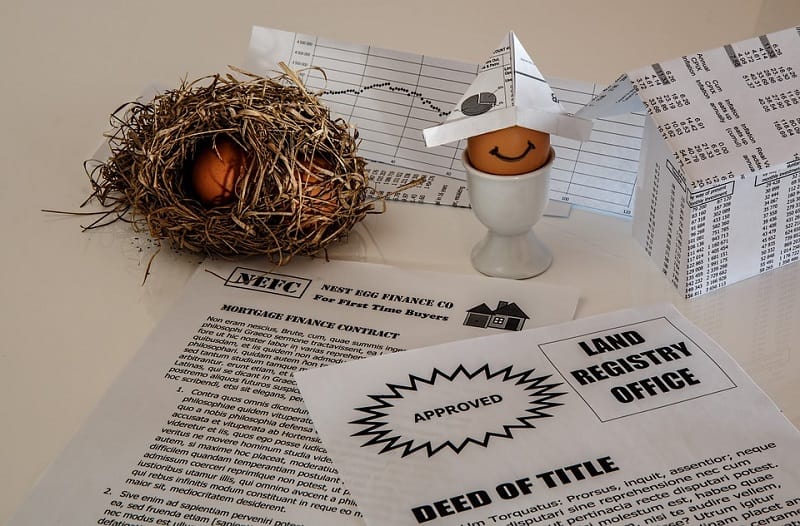

1. Stay Organized And Optimize Accountable Plans

If you are running a small business, filing returns could be a painful experience. It entails gathering data over a few days and organizing it.

Some of the data may be unavailable or incomplete. It wastes time and could lead to a lot of stress. But if you get organized, you will save yourself from the unnecessary tax filing pain.

Ensure that you keep the files for taxes at one place. Also, have the income and expenses categorized well in a computer ledger. Learn of the deductions your business is entitled to when submitting taxes. It lowers the tax burden and makes the exercise enjoyable.

2. Track Your Receipts

To maximize deductions, have all the receipts on how your business spent its money in place. Track all your receipts so that you can make accurate deductions and submit taxes on time.

If the tax man decides to audit your business, the receipts will help you to prove that, indeed, it incurred the expenses. It also shows that costs were reported accurately.

3. Always Be Prepared

If you are unprepared, it leads to late submission of tax and filing the returns. It could result in unnecessary penalties which could cost your business.

Such a mishap can be avoided by getting the documents together in advance. It helps you to arrange to make tax payments on time.

If you have no idea of how to file taxes, make use of a professional. It helps to avoid surprises at the last minute.

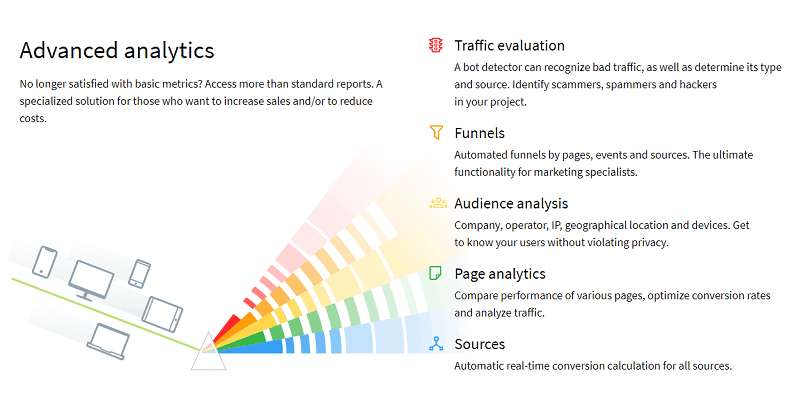

4. Leverage Accounting Tools

Accounting tools can help you streamline the process of filing returns. Software such as QuickBooks can help you have your data organized and file returns on time.

Note that it is embarrassing to start flipping through a hip of papers when the accountant requests for information. QuickBooks can keep accounting records accurately and ensure that they are just a click away.

Also, the software accounts for rules and tax laws, so you need not worry about anything. It reduces the likelihood of errors and simplifies the work for you.

5. Have A Checklist And Set Checkpoint Meetings

Tax maintenance should be an ongoing exercise. It helps to avoid surprises and ensures that everything is done at the right time. Also, it also enables you to understand the important performance indicators of your business.

Break the tax preparation task into bits that can be performed quarterly or even monthly. Lastly, have checkpoint meetings as scheduled to see if you are on track.

At this point, you are now better placed when it comes to filing taxes.

Buy the necessary tools and ensure that you organize yourself to stay on top of things when it comes to tax filing. It will make the process of filing tax returns easy and enjoyable.

Prep work does wonders for growing business. Super tips here.