Running a business comes with multiple responsibilities, from maintaining customer satisfaction to managing operations. In the middle of these, keeping your finances organized can become overwhelming, especially as your business grows.

While some entrepreneurs start out managing their books, it becomes necessary to get professional help at some point. An accountant can be a valuable addition to your team down the line. Let’s discuss seven signs that it’s time to bring one on board.

Table of Contents

You Find Bookkeeping Tedious

Photo courtesy of Unsplash

You may need to hire an accountant for your business if you find bookkeeping tedious. Struggling to stay consistent or dreading financial tasks can cause errors, missed deadlines, and poor cash flow management overall. An accountant can take over these responsibilities, ensuring accuracy while allowing you to focus on other important tasks.

You’re Planning to Expand Your Business

While planning to expand your business can be exciting, it adds a lot of financial complexity. From budgeting and forecasting to managing increased expenses and tax implications, an accountant provides the expertise needed for smart growth. Their insights can help you avoid costly mistakes, ensuring that your expansion is sound and matches your goals.

You Intend to Plan Business Finances Ahead

An accountant can help you greatly if you’re ready to plan your business finances. They create realistic budgets, forecast revenue, and set achievable goals. With professional guidance, you’ll get a clearer view of your financial future, make informed choices, and keep your finances in order. You can also build a solid foundation for growth, stability, and long-term success in your business.

You Are Not Certain About Your Business Structure

Uncertainty about your business structure, whether to operate as a sole proprietorship or corporation, is a clear sign that you need an accountant. The right structure affects your taxes, liability, and future growth. An accountant can assess your situation, explain the pros and cons, and guide you toward the best structure that supports your growth.

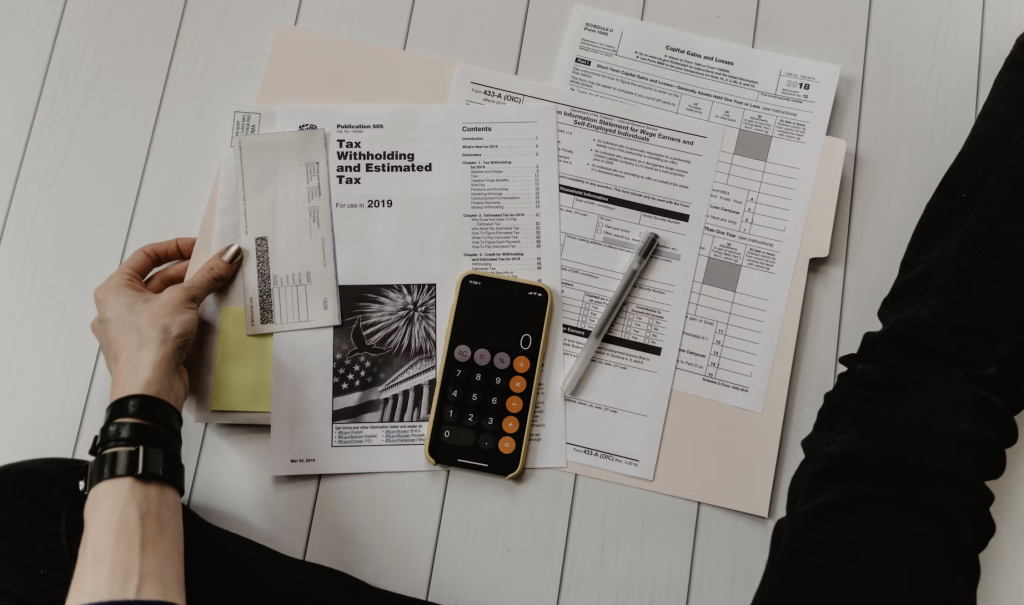

You Don’t Know Enough About Taxes

Not knowing enough about taxes can put your business at risk of errors, penalties, or missed deductions. Tax laws are often complicated and changing, making it difficult to stay compliant without expert help. If you run a small enterprise, an accountant for small business ensures accurate filing, optimizes deductions, and develops strategies to minimize your tax burden.

Your Business Needs Professional Financial Reports

If your business requires professional financial reports for investors, loans, or strategic planning, it’s time to hire an accountant. Accurate reports like income statements, balance sheets, and cash flow statements are necessary for making informed decisions. An accountant prepares these documents correctly, giving your investors a clear view of your company’s financial health.

You Are Facing an Audit

You’ll need an accountant when facing an audit. Audits can be stressful and complex, requiring detailed records and thorough explanations. Effective accounting can help you organize your documents, communicate with tax authorities, and ensure compliance. Their expertise minimizes risk, helps resolve issues, and provides peace of mind.

Endnote

As your business grows, you’ll need an accountant to help manage your finances. These professionals offer valuable help, especially if you’re expanding, facing an audit, or intend to plan your finances. If you find bookkeeping tedious, need professional reports, or aren’t certain of your business structure, you’ll also need an accountant.