Manual payroll systems went out last century but that doesn’t mean things still aren’t changing all the time. Advancements in technology mean that new systems are appearing all the time to make life easier for both businesses and their employees—there’s an added bonus of cost savings too. Let’s explore one such solution.

Table of Contents

Innovative Payroll Programs

Paying employees, freelancers, contractors, and affiliates with the same system is a brilliant investment. Using cutting-edge solutions like Wallester Business payroll card means a new way of paying staff that saves time, money, and energy. This is an all-in-one solution to streamline payroll processes.

How do payroll cards work?

With Wallester, it’s really easy to get started:

- Your first step would be to create a business account on Wallester Business’ platform. This is a simple process involving submitting documents about the company and completing the Know Your Customer (KYC) procedure.

- When things are set up, it’s a case of inviting people to become payroll cardholders. They accept these invitations through the mobile app and are then free to access the benefits the payroll program offers.

- Once everyone is set up on the platform and has joined the corporate group you set up, you can start making payroll payments.

Virtual or physical cards?

Once upon a time, physical cards were the only way to operate. Then came contactless and online payments. The way these systems work—by requiring a long card number and other unique identifiers—means there’s no real need for the physical piece of plastic at all.

Payroll cardholders can use the platform to generate either physical, traditional cards or virtual ones. Once created, it’s easy to transfer funds to them. There’s an application and a short verification procedure to use it but it all takes a matter of minutes. It is still a financial product and so you are required to upload a real-time photo as well as a copy of a piece of government-issued ID (passport, driving license, ID Card). But once this is done once, you won’t need to repeat this step.

How do payments work?

All accounts are separate from one another and properly secure. There’s a small monthly fee each month for every employee card. To make payments to the cards, you can do it in a number of ways. For batch payments, you can use CSV, Excel, or XML formats. It’s really easy to upload data and make simultaneous, effortless payments.

Businesses also don’t need to make changes to their existing systems. Payroll cards integrate with existing accounting software like Quickbooks among others. And you don’t even need to worry about costs either—you won’t pay any fees or commissions when you transfer from the company account to a cardholder account.

How do payroll card holders then access their funds?

So, you’ve set up cards, transferred funds to cardholders, now what? Well, cardholders have plenty of ways to access their money—and they’re all quick and easy.

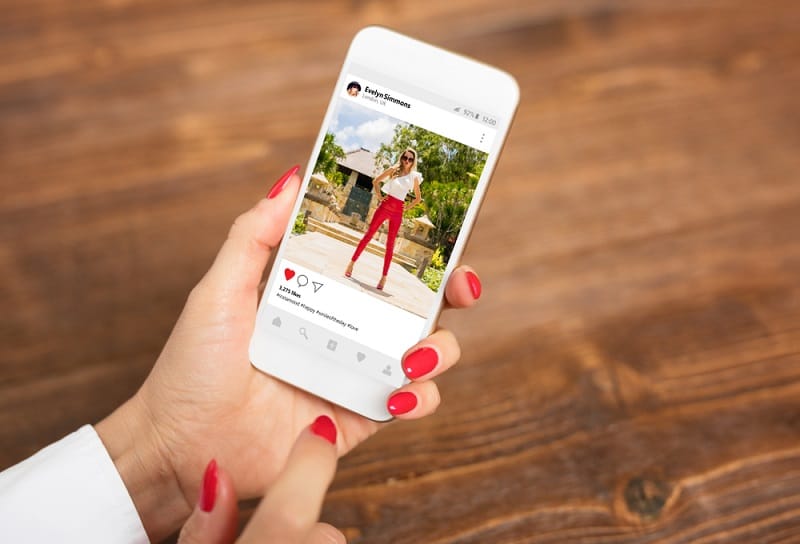

Once the funds have been processed, cardholders have immediate access to them through the app (it’s available on both iOS and Android). They can then either use a physical or a virtual card to spend the money.

The payment experience is seamless and makes it really easy to manage finances. The card solution (both physical and virtual) is managed by Visa—so you know just how versatile they are and how widely accepted they’ll be.

FAQs

What is a payroll card?

This is like a prepaid debit card essentially. It’s a way for employers to pay employees without them having to send payments to their bank accounts directly. It’s an alternative to direct deposits and other ways of being paid.

What types of payroll cards exist?

These are available as branded cards like Mastercard or Visa or as personalized cards carrying the employer/company name. There are instant-issue cards like virtual cards as well as portable ones that can accept money from alternative sources besides the employer.

How do payroll cards work for employees?

Employees receive their earnings on their payroll cards on pay day. It’s very much like a direct deposit into your bank account only all of the funds go onto the card. The card can then be used to pay bills, shop, or withdraw cash.

What are the benefits for the employer?

It saves money and is simple to set up. They’re also reliable.

What are the benefits for the employee?

For employees, funds are available and cleared as soon as they’ve been sent. The card is easy to use by anyone—no matter their usual bank account. The cards are also useful for financial wellness because they can help employees manage their budgets. Some retailers even offer discounts for using payroll cards. Finally, some cards allow employees to access their earned wages before payday hits so they can avoid using a credit card if they have an emergency bill to pay, for example.