Launching a new business venture comes with equal doses of excitement and vulnerability. Among the various responsibilities that business owners face, securing the right commercial business insurance is critical. This insurance serves as a protective shield, safeguarding the business from unanticipated incidents such as accidents, natural disasters, and legal liabilities. While the process of choosing the right insurance might seem overwhelming, having clear insights into different coverage types can help tailor a policy that meets your specific needs and ensures business longevity.

Every business has unique risks determined by factors such as industry, location, and size. Recognizing these risks is essential to effectively manage potential threats. This guide seeks to give entrepreneurs a thorough understanding of the various kinds of business insurance that are available, enabling them to make well-informed choices that strengthen their company’s foundations against unforeseen obstacles.

Table of Contents

Understanding Business Insurance Basics

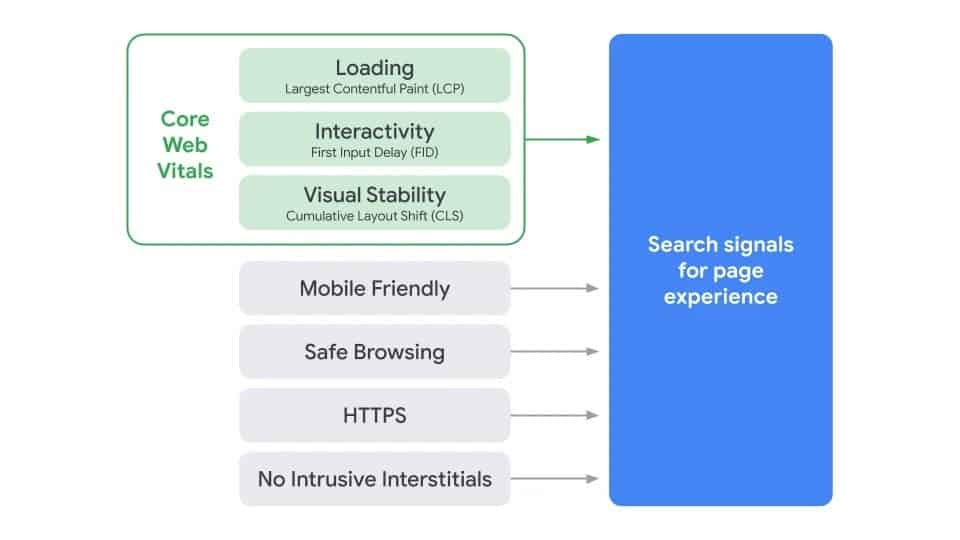

Business insurance encompasses a variety of policies, each crafted to mitigate specific types of risks. Rather than a one-size-fits-all solution, business insurance requires a personalized approach. Entrepreneurs should evaluate the specific risk factors associated with their industry. For instance, a tech startup may prioritize cybersecurity policies, while a retail operation may focus more on liability and property insurance. Understanding these nuances is crucial, ensuring both compliance with legal requirements and protection against real-world risks. A comprehensive insurance strategy is a cornerstone of resilient business planning.

General Liability Insurance

Often regarded as the cornerstone of a solid risk management strategy, general liability insurance provides the broadest form of protection for businesses. It covers the essential legal defense costs and any potential settlements associated with accidental injuries or damage claims. This could arise from something as simple as a customer slipping within your premises or claims of defamation in advertising. Having robust general liability coverage along with a trustworthy personal injury lawyer to call in case of an emergency will protect against financial disruptions and enhance the credibility of a business, showcasing readiness to handle customer and client relations responsibly.

Property Insurance

For businesses with a physical presence, whether rented or owned, property insurance is indispensable. It provides financial protection against unforeseen damages caused by events like fires, storms, vandalism, or theft. This insurance encapsulates the building structure as well as inventory and operational equipment within. With property insurance, companies can prevent a tragic loss from becoming devastatingly irrecoverable. A detailed and customized property insurance policy ensures businesses can continue operations with minimal interruption, even after a significant loss.

Workers’ Compensation Insurance

Hiring employees comes with responsibilities and legal obligations. Most jurisdictions have laws requiring workers’ compensation insurance to pay for medical bills and lost wages for workers who suffer illnesses or injuries at work. This policy not only provides peace of mind for workers, knowing they are protected but also shields businesses from potential lawsuits. It fosters a safer workplace by promoting thorough safety protocols and compliance, ultimately reducing the incidences of workplace accidents.

Commercial Auto Insurance

Businesses that rely on vehicles need to consider commercial auto insurance. This policy covers a range of conditions involving business-related vehicle use, including accidents, theft, vandalism, or damages caused by the vehicle’s operation. Whether your enterprise uses delivery vans, company cars, or mobile equipment, securing the right insurance can prevent costly legal battles and financial losses stemming from vehicular incidents. Commercial auto insurance resources can offer valuable insights into crafting the appropriate policy.

Professional Liability Insurance

Known in some industries as errors and omissions insurance, professional liability insurance protects businesses that provide expert services or consulting advice. This coverage is particularly important for professions such as legal, healthcare, and financial services, where client interactions can have significant impacts. In cases where negligence, misrepresentation, or inaccurate advice is claimed to have caused financial harm, professional liability insurance steps in to manage defense costs and settlements, thereby protecting the firm’s reputation and financial stability.

Data Breach Insurance

In the digital age, protecting customer data has become a top priority for businesses of all sizes. Data breach insurance is an essential policy for businesses that handle sensitive customer information. This insurance covers costs associated with a data breach, including legal fees, notification charges, and credit monitoring for impacted customers. As cyber threats become increasingly sophisticated, having data breach insurance ensures that businesses can manage the recovery process smoothly and promptly, minimizing reputational damage and financial losses.

Business Interruption Insurance

Natural disasters, fires, or other unpredicted events can force businesses to pause operations temporarily. Business interruption insurance helps control costs that continue to mount during the outage and compensates for lost revenue. Businesses that mostly depend on their physical location to make money will especially benefit from this strategy. By providing the necessary funds to recover and reopen swiftly, business interruption insurance helps sustain a steady income flow and maintain employee retention during difficult times.

Final Thoughts on Choosing the Right Insurance

Selecting the appropriate combination of insurance policies requires thoroughly evaluating your business’s specific needs and potential risks. Consult with insurance advisors to craft a customized insurance portfolio that aligns with your business operation model and growth strategy. A well-planned insurance structure not only provides a safety net against business uncertainties but also exemplifies a commitment to sustainable and responsible entrepreneurship. Investing in comprehensive insurance coverage is not just a defensive measure but a proactive step toward ensuring long-term success and stability in the ever-evolving business landscape. For entrepreneurs aiming to protect their ventures, a balanced and informed approach to insurance will serve as a foundational pillar for business resilience.