Why is proprietary trading, commonly known for short – prop trading, so popular? Well, it’s probably because, where possibly you would be able to to trade with more capital than you may have available to fund yourself. Nowhere, of course. But that’s what all the hype is about. Prop trading firms trade their own capital instead of client’s funds. These days, some of the top prop firms for crypto trading are leading the way, giving traders a real shot at bigger opportunities in the market.

Table of Contents

What is Proprietary Trading

Definition of Prop Trading

Prop trading is basically when a firm uses its own assets instead of your money. Sounds pretty cool, am I right? Finally, trading where you don’t need to sell your own kidney in order to try it out. That’s what I like the most—especially with firms like Funding Rock. The possibility of testing it is what matters. I don’t want to sell my car in order to check it out.

Of course, it’s important to get some knowledge first. It’s not a game, although it might feel that way at times.

There are a lot of prop trading firms, so it’s not easy to pick one. Therefore, some prop firms specialize in certain asset classes. If they focus on a specific market segment, they can stand out.

Why Prop Trading Really Matters in Today’s Markets

Prop trading is important for financial markets because it brings innovation, and it helps with liquidity as well. Because of investing their own money in the market, prop firms make remarkable contributions and impact on the market activities.

Prop firms that allow high-frequency trading (HFT) enables traders to complete multiple trades at incredibly fast speeds. HFT is a type of algorithmic trading in finance that is characterized by high speeds and high turnover rates.

The Structure of Proprietary Trading Firms

How Prop Firms Operate

As I already said, prop trading firms provide capital to traders, who then trade. Of course, that can’t be for free. In return, the firm takes a percentage of the trader’s profits. The primary way prop trading firms generate revenue is through challenge fees.

However, the majority of prop trading firms also offer training and mentorships. They want to help traders to stay updated on market trends and learn more. They want to invest in traders, so they can ensure they will later have a competitive trading team.

Risk Management in Prop Firms

Understanding risk management is highly important, if you’re aiming on passing that prop trading challenge. First, you need to define your risk limits. What would also be essential is to control your fear, greed, and overconfidence to avoid impulsive decisions. You will regret it later, so go slowly. Don’t rush.

Get informed, learn and use those analytics dashboards. You can also keep a trading journal, where you will log trades, risk metrics in order to identify patterns and improve strategies.

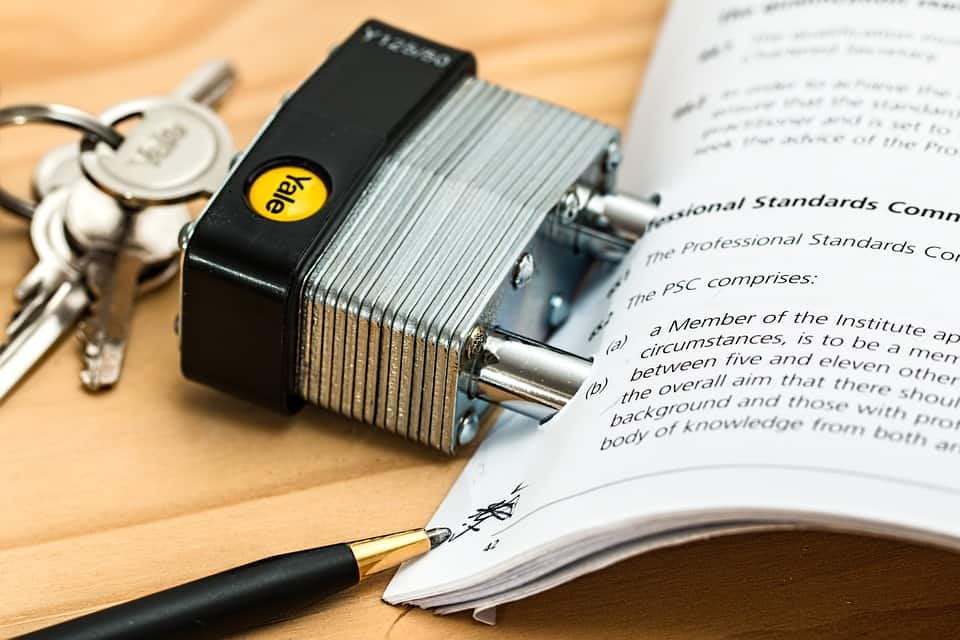

Tax Implications for Proprietary Traders

Understand Trader Tax Status

If you are just starting out to trade, chances that you will qualify for trader status are quite slim. It’s challenging to be eligible for trader tax status (TTS). Frequency, volume and average holding period are the most important factors, because they are more accessible for the IRS to verify.

When talking about frequency, I advise trades on about four days per week, around a 75% frequency rate.

My recommendation for volume would be an average of three-four transactions per day, four days per week.

As some people say, the average holding period should be 31 days or less.

Prop traders have unique tax considerations comparing them to traditional traders. The Internal Revenue Service (IRS) classifies traders as either “trader” or “investor” for tax purposes. It really can have a nice impact if you will go big or go home as a trader.

In conclusion, it is cool to be a prop trader, since you can enjoy certain tax benefits, such as deducting trading-related expenses. But as you know, however sure you are, you trade on your own risk. Be careful.