Financial independence is a function of your last payday. That last check opens a future defined by your life thus far. It can mean a comfortable life in retirement or the need to work for supplemental income.

A strategy for achieving financial independence will reduce your stress. As David Ning wrote in U.S. News Money, {You will be much less stressed out. It’s no secret that money decisions add stress to many people’s lives. But it may surprise you to learn that much of the tension in other areas of your life could be indirectly caused by a lack of funds.”

With less on your mind, you find it easier to shift your focus to work, creative outlets, family adventures, and supportive friends. When you can take one burden off your plate or back, you can restore the energy to accomplish more things you enjoy. When you reach the stage where you work the way you want to and not the way you must, you do what’s meaningful to you.

If you plan your financial future, you can pursue meaningful self-improvement because you have the time. But, it’s also true there’s no guarantee to continued employment. In a world of mergers and acquisitions, most people find themselves changing jobs frequently. It’s also true laid-off workers or employees in transition are vulnerable to myriad financial pressures—if they don’t have a financial plan in place to see them through their unemployment. You can, then, assure a stress-free transition as you move on.

It’s never too early to plan your financial independence, and these guidelines might help take you there.

Table of Contents

It Can Be Too Late

You can’t believe advice saying it’s never too late to find financial freedom. Well, starting late is better than not starting at all. But the earlier you start to plan and save, the bigger you’ll find your financial freedom.

It’s all age-related, your age and your savings’ age. To make a difference, you must start putting money aside with your first job. It may mean living below your means or tightening your spending belt, but your future capabilities depend on your personal discipline. The upside is you will get used to it the sooner you get into it.

You May Be Financially “Illiterate”

They may teach math and accounting in school, but most schools do not teach financial literacy. You need more information on household budgeting, personal spending, savings vehicles, and more. There is software to help, and many bank websites provide budgeting tools.

You can also find help at your local library so checkout titles like the following:

- Your Money or Your Life by Vicki Robin has a fun title but offers little investment advice. What it does well is work on your mental discipline. It will introduce you to better spending and savings habits. It will help you appreciate being mindful in your approach to financial freedom from financial dependence.

- Building Wealth and Being Happy by Graeme Falco targets millennial worker. It assumes correctly the millennials approaching middle age or looking towards retirement are not positioned to have the financial independence they expect from their better than average incomes. It addresses issues relevant to them like saving on a freelancer income, the risks in putting all their money into startups, and the pros and cons of renting or buying real estate.

- The Intelligent Investor by Benjamin Graham covers investment tools, strategies, and markets. It’s a long read but serves well as a reference book. Originally published in 1949, the latest revised edition continues Graham’s advice on “value investing” to shield investors from substantial mistakes. Warren Buffet swears by the book and calls it “By far the best book on investment ever written.”

- The Only Invest Guide You’ll Ever Need is a boast made by Andrew Tobias. Another book written some time ago, it’s been updated to engage millennials. Furthermore, it has a current website, contemporary investment tools, and recommendations that make sense to the generation. In addition to investment advice, it covers other financial necessities like insurance and taxes.

- The Four-Hour Workweek by Tim Ferriss is subtitled “Escape 9-5, Live Anywhere, and Join the New Rich.” It’s written for the entrepreneur, digital nomad, and gig worker career worker. Ferris, himself, originated the digital nomad concept as a career path and continues to hold their attention. He outlines a more efficient lifestyle to empower and enrich your savings options.

Time Equal Financial Freedom

Gamblers don’t save money or retire rich. There is no profit in throwing money away.

The financial adage—”There are two ways to make money: to work for it and to let your money work for you.”—still holds true. You can make your money work for you if and only if you commit to the understanding financial markets will rise and fall almost at will.

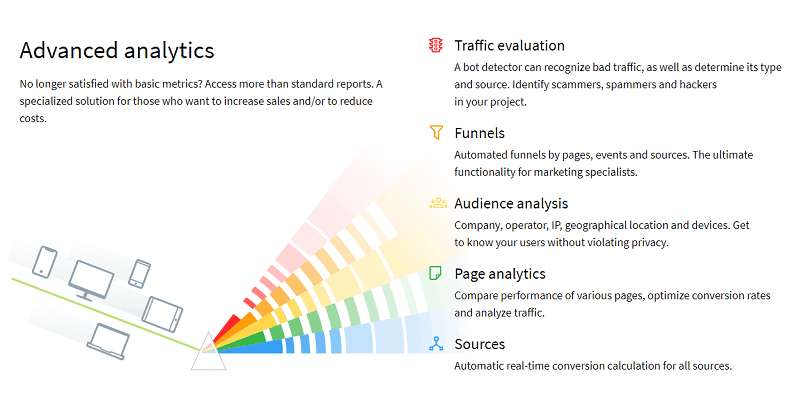

New technologies empower new data for analysts to follow. But even the wealthy investor will admit there’s no way to accurately predict market movement. Only spending time in the market will return the values you want.

Take Advantage Of Your Employer

Employers offer 401(k) Plans for several reasons. It means a tax advantage to them. Such plans tend to retain employees. And, most employees appreciate the convenience.

Most employees don’t realize the employer pays the administrative costs, the labour burden to communicate and enrol the employees, and makes a considerable match to your contributions.

So, employees are crazy not to take advantage of the employer’s offer. The 401(k) Plan should not be your only savings, but it can be the core.

Even Your Debt Can Work For You

The miracle of compound interest works to build your savings in banks and financial markets. But, when you accumulate debt, that miracle works against you.

For example, as you multiply credit cards and pay only the minimum monthly payments, the debt offsets any savings you may pursue. But, you find it necessary to borrow money for short-term emergencies or long-term auto loans, you should check for honest loan reviews online.

Automated Saving And Investing Is The Modern Way

If you commit to a monthly 15% set aside, you should put at least some it into an automated account to restrict your slipping on your plans. Even if you are in the financial markets, investments in mutual funds take the decision-making responsibility off your hands.

The disciplined deposit and automated investment help you invest low and average gains over time.

It Takes A Lifestyle Change

Assuming you want to buy a pleasant home, raise your kids with college in mind, and plan even a modest retirement, you must let those goals determine your planning. These goals are achievable by most Americans if and only if they have a plan and the mental wherewithal to make it happen. It means adjusting your lifestyle early.

You may have to lower your housing expectations, shop for a cheaper car, and begin saving smartly early. It means remaining healthy, educating yourself, and adding your family members to your strategy.

What You Now Know

Building financial independence and achieving incredible wealth are not the same things although achieving wealth is one way of finding financial independence. Realizing your financial independence goals means changing your life’s patterns.

You must learn early to budget and to align the budget with your current and hoped-for lifestyle. You must commit to the discipline the budget demands, but you want to build in enough flexibility for emergency expenditures and life-changing events.

If your financial independence is related to financial markets, your budgeting discipline must align with your commitment to patience during the markets’ volatile periods.

Financial independence assumes you change your value system. For example, there are no savings to you if you spend money to compete with neighbours or co-workers. Even if you have cash in hand to buy a better barbecue or bigger boat, you spend money that would do more for you in the bank.

You may not pull this off without a qualified financial planner. Kevin Voight, a contributor to NerdWallet, says, “You don’t need to be wealthy to reap the benefits [of a financial planner]: The universal goal of financial planning is to create an ongoing process that will reduce your stress about money, support your current needs, and build a nest egg for retirement.”

Most people are not trying to get out of work. Most people, at least, enjoy working at something they enjoy. What they want is to eliminate their dependence on someone else. While an employer consumes their time, risks their financial future, and commits them to work they don’t enjoy, most people prefer to control their own lines.

Everyone has financial goals, small ones and large. Some overlap and some remain unrealistic. But, you also need help to draw your financial roadmap and sticking to its preferred routes. A formal financial plan tests you with flexible options, short-term and long-term goals, and the strategies and tactics necessary to take you where you want.

Starting early to build your savings is so key Erik. Build a business, add income streams, live humbly and those numbers grow over time. Fab post bro!

That’s a nice article about financial independence. It is in my mind that multiple streams of income can lead to financial freedom. Actually I often read articles about some passive opportunities such as crypto currency, or trading. So, what do you guys think about multiple streams of income? Thank you