Arbitrage funds are gaining traction among investors in India due to their unique blend of stability and returns. These funds exploit the price differences between different stock exchanges and markets and have emerged as a lucrative investment avenue.

Particularly, those looking for low-risk opportunities and better returns compared to liquid funds prefer investing in arbitrage funds. Read on to know why arbitrage funds are gaining popularity among investors.

Table of Contents

What Are Arbitrage Funds?

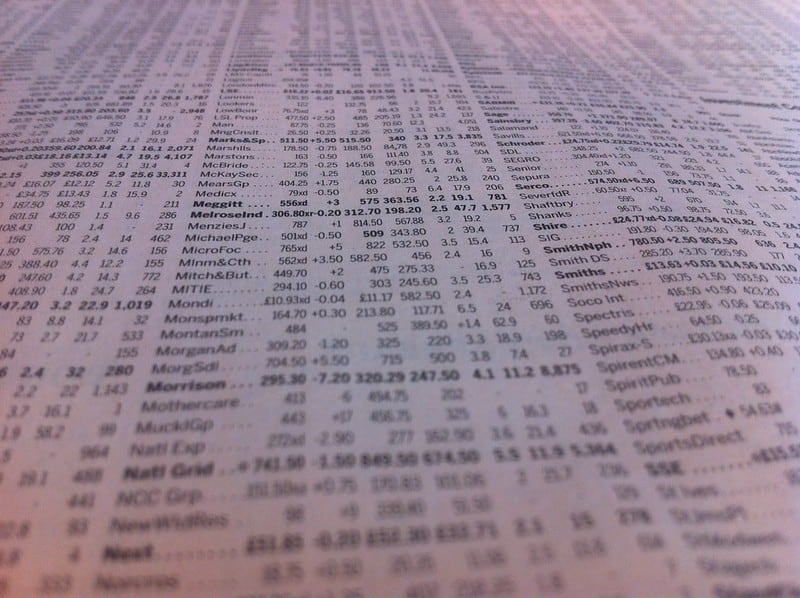

Arbitrate funds capitalize on the price discrepancies between different stock exchanges to generate profit. For instance, a fund manager may buy a stock at a lower price at NSE and sell it at a higher price at BSE when there’s a discrepancy in stock value between the two exchanges.

Arbitrage funds may also generate profit by capitalizing on the price differences between the present and future values of a stock.

Considering the relatively low risk involved in arbitrage funds, investors are gradually turning to this category. If you are willing to invest in mutual funds, check out the best arbitrage funds on the popular mutual fund platform, Dhan.

What Makes Arbitrage Funds so Popular?

Do you know that arbitrage funds in India witnessed the highest inflows among hybrid funds in FY2024, at INR 90,846.11 crore? Why do you think these funds are attracting investors in large numbers? In this section, we will find out why these mutual funds are so popular.

-

Stable Returns at Low Risk

One of the primary benefits of arbitrage funds is their ability to provide returns at low risk. The strategy of fund managers of these funds involves exploiting the price inefficiencies in the market. The approach is all about hedging against potential losses, which makes these funds less volatile compared to equity funds.

Investors looking for a safe avenue amidst market fluctuations often find arbitrage funds to be a reliable choice. Some arbitrage funds even outpace liquid mutual funds as well as traditional fixed-income investments.

-

Tax Efficiency

Investors putting their savings into arbitrage funds enjoy significant tax benefits. In India, these funds are treated as equity funds for tax purposes. This means, investors can benefit from long-term capital gains tax rates.

For Indian investors, this is a crucial point to consider. Compared to debt funds, long-term capital gains tax on equity funds is lower. This makes arbitrage funds an attractive option for those looking to maximize their returns post-tax.

-

Diversification of Portfolio

Arbitrage funds are not directly associated with the performance of the equity market. Rather than market movements, their returns come from price discrepancies. This makes arbitrage funds an ideal option to diversify your portfolio.

-

Liquidity and Flexibility

For many investors, liquidity is a key consideration while putting their money in mutual funds. Arbitrage funds offer good liquidity, which allows investors to enter and exit positions easily. This is particularly beneficial for investors who might need access to their funds on short notice.

-

Consistent Performance

The track record of arbitrage funds speaks for itself. In recent years, these funds have consistently delivered steady returns, which make them a dependable vehicle for investment.

Amidst economic uncertainties like inflation and unpredictable markets, investors get a much-needed anchor from the consistent performance of arbitrage funds. Regardless of the direction of the market, these funds can generate consistent returns.

Conclusion

Arbitrage funds, with its combination of low risk, stable returns, and tax benefits, appeal to investors as a lucrative avenue. Both beginners and seasoned investors looking for stable returns are turning to the best arbitrage funds.