Money has always been a problem for students. Education consumes much of it and often leads to long-lasting student debts and loans. However, what if we said that a lack of money could easily be dealt with if you start investing early?

The value of money augments if it is put in motion. If you save funds ‘under the pillow,’ do not expect them to multiply. The best thing you can do when you turn 18, is to study the market and invest even in small amounts.

However, it is hard to do if you lack financial advice and do not know what to invest in. Finance writers claim that investing and investment management do not get enough attention in the school curriculum. In the end, students learn a lot about theoretical macro-investing but hardly ever use their skills in practice.

In this article, we are going to discuss several key tips that would be helpful to students who want to start investing when they are young. Such a strategy can maximize their income over the years.

(source: https://unsplash.com/photos/OlSGcrLSYkw)

Table of Contents

Analyze Your Situation

A part of financial wisdom is to invest when it is the right thing to do. You should take a closer look at your finances if you are in debt. These debts can be different in nature. For example, if you have a credit card debt, it is worth paying off before even getting started with investing.

If you have a student debt, which is split into several parts over a longer period of time, investing still makes sense. Interest rates on student loans usually do not exceed 5% or 7%. It makes investing reasonable if you put a lot of thought into it.

Increase Your Knowledge

Do not let your investing choices be emotional. You should have a clear understanding of what you do and why. Thus, you have to learn more about the stocks, company, fund, or market you choose to invest your money in.

Read professional literature, study investment guides, and take every opportunity to learn more online. The better you are prepared, the more effective your investment will be. Overall, you need to learn the basics enough to build strategies if you want to turn a small investment into a fortune.

Activate Your Savings

Before you get started with investing, you need to save some money. To have enough money to make your investment, think ahead of time, and make small savings over the course of several months. You don’t necessarily need to squeeze your budget. You need to understand what amount of investment you can make every month to keep your life comfortable.

It is a good idea to automate your savings if you can do it. You will not count these amounts in your income, so you will be able to let this money go easier.

Start Investing with Little Money

(source: https://unsplash.com/photos/NpTbVOkkom8)

It is wrong to assume that you need lots of money to start investing. You can start options trading with as little as $1000 and make money on this amount. It is even better to start with small sums before risking with a larger one.

However, do not expect to profit significantly during the first years. It might take several years before you start making real money on your investment strategies. In this case, your biggest advantage is your young age. The earlier you start, the more you get in 10 or 20 years.

Invest Each Month

Investment strategies all depend on stability. It is the right choice to invest a little every month, and make it your routine. Even modest amounts each month can help you get used to this habit of investing.

Moreover, such stability and regularity can help you see your money in action. As an investor, you will see how you perform in the stock market and subsequently learn to diversify your portfolio. Also, consistency will help you get more motivated to track market performance.

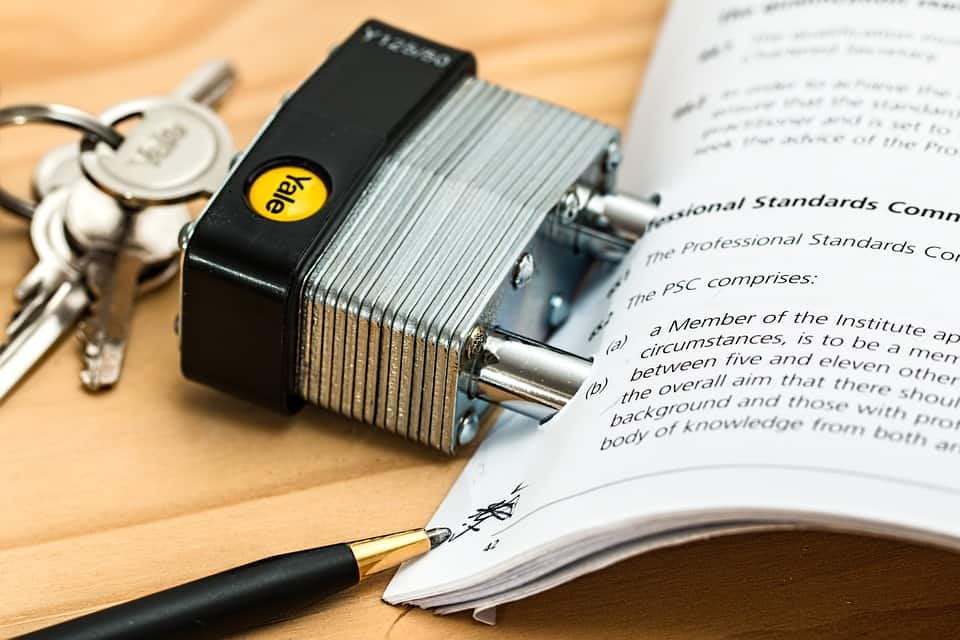

Use Professional Help

Many students consider it wrong or unreasonably expensive to pay for investment advice or help. However, it is actually the right thing to do if you want to start but do not know how. Brokerage services or investment fund clerks can help you out with it.

If you start making money investing, you will see that the fees brokers charge are not that high. In exchange, you get access to professional help, consulting, and internal resources. Thus, consider referring to professionals if you doubt your knowledge.

Final Words

Investing is a good thing if you know how to handle it. It does require time and effort on your side, as well as certain skills. But, most importantly, the earlier you start investing, the more disciplined you become in managing your money.

You are not expected to make millions in the first year. If you start during college years, you’ll have enough time to study investing at your own pace. Make small steps and never hessite to use professional help, and it will definitely pay off.

Hi Erik,

A great investment plan for the begginers.

The step by step stipulated in the post will surely help one to take a right decision in this regard.

Early is the best time to move forward to gain more profits.

Thanks for the share.

Will share with my social circle 😁

Keep sharing.

Best Regards

~ Philip

Hello Erik,

Great Post. Investment requires a proper market research and planning. You have mentioned some great and helpful tips to make investment wisely that help newbies to established a successful business.

Hello Erik,

It is true that a lot of planning and strategies are required for investment. There are still some people pretending that investing less does not yield results. But this is not always true. I still invest a portion of the sum as the right investments really uplift the way of life and stabilize it.

Thanks & Regards

Aria Mathew

Most 18 year old’s don’t have good money saving habits, so they should begin practicing saving money when they receive it first. If you’re 18 and you have a job, on every paycheck that you get – simple put aside $50 and put it into your savings account. Don’t touch it for any reason, as you will want to build this up for something highly important in the future.

You will want to get a secured credit card to start building up your credit, and if you need a vehicle, see if your parent or a responsible guardian can co-sign on a loan for you for you to get financing – so that you can build up your credit. These are the beginning steps to investing and building up your financial portfolio before you get started investing in stocks, retirement accounts, and even purchasing a franchise as a business venture.

That purely true as investing is very important part of money building. Without investing we cannot outreak the profit margins to sky. This means a lot to me as I am turning 18 and after reading your article I am smartly rectify the investing fields.

Your writing is very helpful and helps beginners can learn a lot. Thank you for sharing.

Hi Erik,

Indeed, money won’t multiply keeping it under a pillow and that’s a helpful article to understand the need of investment for beginner to startup.

great idea to Start Investing in 18, very helpful Tips for Investing… thanks for sharing great tips

Brilliant ideas!

My cousin you turn 18 nest year, I will show this post to him. Definitely it will be really helpful to him