In today’s competitive financial industry, standing out from the crowd requires more than just traditional advertising.

With digital marketing becoming increasingly vital, it’s crucial for financial companies to leverage effective SEO strategies to dominate the market.

But, how do they do that?

This article explores proven SEO and marketing tactics tailored specifically for financial firms to stay ahead of the competition.

Table of Contents

1. The Power of a Well-Defined SEO Strategy

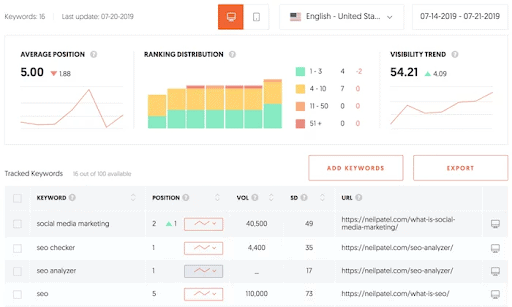

At the heart of any successful digital marketing campaign is a solid SEO strategy. For financial companies, this means creating a search engine optimization plan that targets the right keywords, enhances website usability, and improves visibility on search engines. When done correctly, SEO helps your company appear in relevant search results, driving organic traffic to your site.

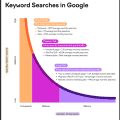

Start by identifying the keywords that are most relevant to your audience. For instance, if you’re offering wealth management services, terms like “best wealth management strategies” or “investment planning for high-net-worth individuals” will be important. However, don’t just stop at keywords; focus on long-tail keywords that are more specific to your offerings. These keywords can lead to highly qualified traffic that is more likely to convert.

Incorporate these keywords naturally throughout your website—whether it’s in your blog posts, service pages, or even in titles and meta descriptions. Avoid keyword stuffing, as this could harm your rankings. It’s about relevance and readability, not just optimizing for search engines.

2. Creating Compelling, Educational Content

Financial services can often seem dry and difficult to understand for the average consumer. That’s where high-quality, educational content comes in. Offering insightful content, such as blog posts, articles, and whitepapers, can build trust with your audience. It positions your company as an expert in the field while also helping your website rank higher in search engine results.

Content should address the pain points and questions of your target audience. For instance, “How to plan for retirement in your 30s” or “What to do when market volatility impacts your portfolio” are both highly relevant topics. A strong content strategy will also include the use of videos, infographics, and case studies that further engage your visitors.

When producing this content, it’s vital to stay on top of trends in the financial industry. As an example, according to Investopedia, trends like blockchain technology and fintech innovations are shaping the financial landscape, and your content should reflect these topics.

3. Optimizing for Local SEO

Local SEO is crucial for financial firms that serve specific geographic areas. If you run a financial advisory firm in a particular city, it’s essential to ensure that your business shows up in local searches. Google My Business is a tool that can help you get noticed in local searches, but you’ll also want to optimize your website for location-based keywords.

Adding location-based keywords like “financial advisor in Los Angeles” or “best wealth management in Chicago” to your site’s metadata, blog posts, and service pages can improve local rankings. Including your business’s name, address, and phone number (NAP) consistently across your site and other online directories like Yelp, Yellow Pages, and Facebook will further boost your local SEO performance.

Additionally, earning local backlinks from authoritative local websites or news outlets can strengthen your local SEO efforts and improve your domain authority.

4. Link Building for Authority

When it comes to SEO, backlinks remain one of the most important ranking factors. Backlinks are essentially votes of confidence from other websites, telling search engines that your content is trustworthy and authoritative. For financial companies, earning backlinks from respected industry sources is especially important.

Focus on creating valuable content that other reputable websites want to link to. This can include comprehensive guides, research-backed reports, and expert opinions. Additionally, you can collaborate with other companies in your niche to earn backlinks through guest posts, joint webinars, or co-authored articles.

If you’re unsure where to start, a fintech SEO agency can help you develop a link-building strategy tailored to the unique needs of your financial business. They can help identify high-quality link opportunities and ensure that your backlink profile supports your broader SEO goals.

5. Leveraging Social Media for SEO

While social media may not directly impact SEO rankings, it’s an invaluable tool for building brand awareness and driving traffic to your site. Platforms like LinkedIn, Twitter, and Facebook provide financial companies with the opportunity to engage with a broader audience. Sharing insightful content, industry news, and company updates helps boost your visibility.

Social media also allows you to interact with potential clients in real-time. Responding to comments, participating in discussions, and addressing questions can establish your company as an approachable, trustworthy authority in the financial industry.

6. Improving User Experience (UX) for Higher Conversions

User experience plays a significant role in SEO performance. Search engines like Google value websites that provide a positive, seamless experience for visitors. If your website is difficult to navigate or takes too long to load, potential clients may leave, resulting in a high bounce rate, which could negatively impact your rankings.

Ensure your website is mobile-friendly, as an increasing number of users are accessing websites via smartphones. This includes optimizing images, improving load speeds, and ensuring that calls to action (CTAs) are easy to find and engage with.

Offering a smooth user experience helps increase the likelihood that visitors will take action, whether it’s filling out a contact form or signing up for your newsletter. This, in turn, can improve your conversion rates and help your business grow.

7. Utilizing Paid Advertising to Complement Organic SEO Efforts

While SEO is a long-term strategy, it can take time to see significant results. To supplement organic efforts, consider using paid advertising to target potential clients more directly. Google Ads and social media ads allow financial companies to target very specific demographics, such as age, income level, or geographic location.

Paid ads can give you the visibility you need to attract more leads while your SEO efforts continue to build long-term organic traffic. Be sure to align your paid campaigns with your overall SEO strategy so that you are targeting the right keywords and audiences.

Conclusion

In today’s competitive financial market, mastering both SEO and digital marketing strategies is vital to outperforming competitors. By focusing on a comprehensive SEO strategy, creating high-quality content, optimizing for local searches, and building authoritative backlinks, financial firms can boost their online presence. Additionally, enhancing user experience and leveraging social media and paid ads can help ensure that your financial services are seen by the right people.