Currently, investing is mostly associated with bonds and shares. Most people still think that investing is a risky activity and is suited to only those who are wealthy. However, investing is not just an effortless activity; it can also be done by people having limited funds.

Young people can consider investing as an enjoyable activity. There are several ways to invest, from real estate investments, precious metals, digital currency, and more. Please read this article to know more on this subject. Before we start, please understand that investments, if done early, can fetch handsome rewards. If you are young and have just landed a job, start investing now.

Table of Contents

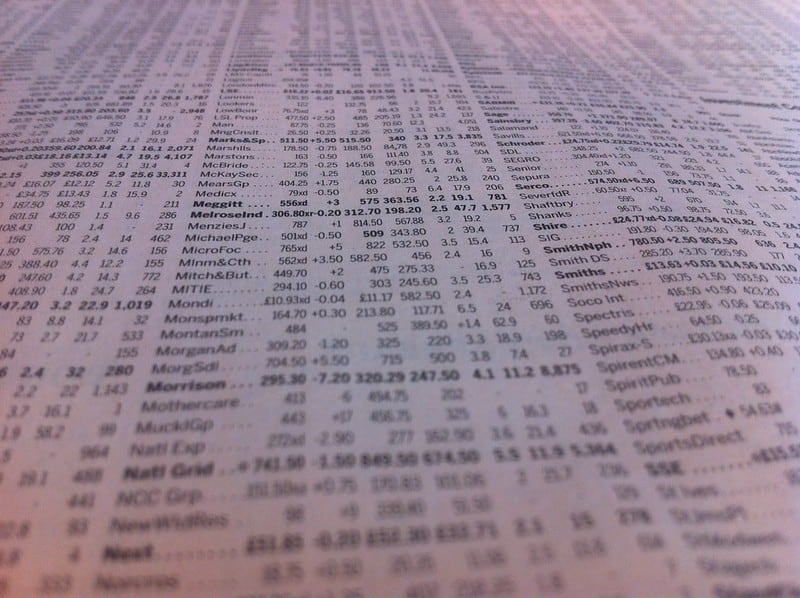

1. Stocks and Shares

This is the most common form of investing all over the world. Stocks or shares represent the ownership of a company. The best time to buy stocks is directly from the promoter at the time of the launch of the IPO or Initial Public Offering. If you lost that opportunity, you might buy the same shares from a share broker. In the latter case, you would have to pay a certain brokerage or commission to him.

The prices of the shares rise and fall according to the fortunes of the company and its industry sector. Some companies reward their stockholders with dividends while others reinvest their company profits for future growth.

2. Bullion

The term’ bullion’ means gold, silver, and platinum. Many investors buy gold and silver as part of their investment strategy.

But why do they do so? There are several reasons. The main ones are:

Hedge against inflation

When prices rise, gold and silver act as some hedge against inflation. For example, if your income isn’t growing at the same rate as inflation, your bullion investments can rescue you.

When the value of your assets falls considerably, your gold and silver would still hold a lot of value.

Hedge against the U.S dollar

After gold, the U.S dollar has the maximum value in the world. But this currency also keeps on fluctuating due to several reasons. If you have made investments that are closely linked to the value of the dollar, consider investing in bullion as well. Your gold and silver investments would protect the rest of your portfolio in case the U.S dollar crashes down. If you are considering buying gold and silver, click here.

Most people go in for gold investments because the price of this metal is relatively constant. You can also trade it easily with other currencies all over the world. Plus, holding gold means you are wealthy. Silver is also an attractive metal but is not as precious as gold. Its value is chiefly dependent on its industrial applications.

Of late, more and more investors are interested in this metal because of the solar panel technology. Silver prices will improve because this metal is being increasingly used in solar panels. You may also consider investing in platinum for the same reasons as silver. Platinum prices depend upon their industrial applications like the automobile industry.

3. Real Estate

If you are in for a long haul, then you may consider investing in real estate like residential or commercial plots, apartments, shops, etc.

Prices of real estate appreciate over the long term. They depend upon government policies — supply and demand, and in some cases, overseas investors.

We’d suggest you do some serious research on real estate investing.

4. Bank Instruments

You can either save your income in savings deposits and get some interest or invest in fixed deposits.

You can either save your income in savings deposits and get some interest or invest in fixed deposits.

Fixed deposits have a fixed tenure and have a fixed investment as well. Interest from savings deposits is usually lower than FD interest.

There are other investment avenues, too, such as debt instruments, government securities, bonds, mutual funds, etc. However, the above four are the safest for the younger lot.