If you study a list of failed companies, you’ll readily notice that poor cash flow is one of the primary causes of business failures. And it automatically follows that accounts receivable is one of the central contributing factors to failed cash flow.

If you want to enhance your cash flow and build an efficient operation, you probably ought to improve your accounts receivable process.

Table of Contents

The Challenge With Accounts Receivable

If you’ve been in business for any length of time, then you know just how painstaking and frustrating accounting can be … especially if you don’t have a background in accounting. In particular, accounts receivable — or the portion of your cash flow that’s yet to be received — can be a major source of problems.

“Accounts Receivable is sort of part of a no man’s land between inflow and outflow. It will be inflow, but isn’t yet. And since you made the outlay of the service or product, it’s a cash outflow. But it will be returned,” accountant David Clarke writes.

“Having Accounts Receivable is a positive thing for your business: it means you’re making sales which are an important first step towards business success. But the second step is just as important: collection.”

That’s typically the harder part of the accounts receivable process. How do you extend credit to clients, yet ensure that they pay quickly, efficiently, and in full? It’s an issue nearly every small business owner has to deal with, so it requires an intentional approach.

Four Ways to Improve and Streamline Accounts Receivable

If you study the accounts receivable processes of some of the best firms in your industry, you should perceive that strategy is everything.

As you hone your own approach, keep the following tactics in mind.

1. Automation

Purposeful automation is at the heart of a streamlined accounts receivable process. The more you can automate various aspects of your receivables, from start to finish, the less friction you’re apt to encounter.

For example, you may find it useful to adopt a source-to-pay process to automate and streamline contract processes. Among other things, this can ensure better contract renewal, promote better efficiency, and lead to more seamless accounts receivable activity.

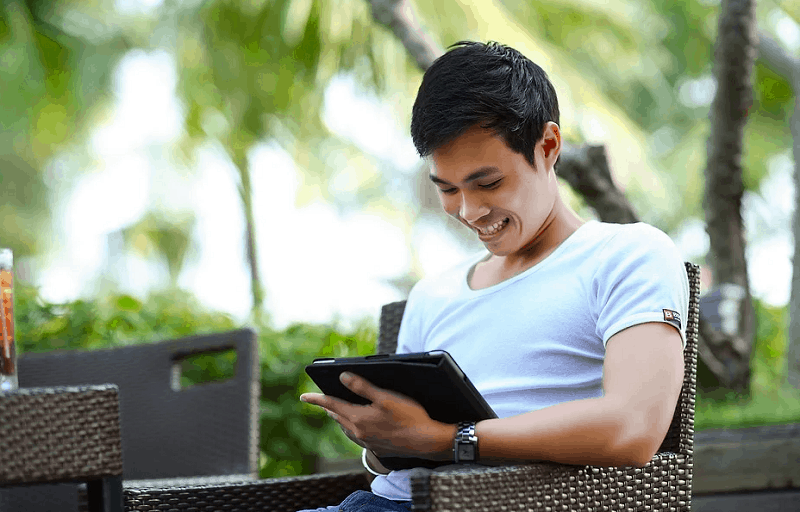

2. Proper Reporting

It’s imperative to maintain accurate customer data — particularly if you scale up. By centralizing the master data process, you should be in a position to maintain a smoother and more effective flow of cash into your operation.

“Customer accounts should be audited on a consistent basis to check for anomalies like unusual or inappropriate payment terms, credit limits, discounts and the like,” CPA Dennis Najjar writes. “Changes to customer data should be properly documented, and controls should be put in place to prevent unauthorized people from being able to access or edit data.”

It’s much easier to address this issue if you do it from the start. Trying to go back and correct a ton of mistakes retroactively is apt to be time-consuming and costly.

3. Move Quickly on Past-Due Receivables

Businesses never want to come across as pushy. If you’re in an industry where your customers have many competitors to choose from, you might fear that proactive collection efforts may push your clients away.

You can’t afford to delay on delinquent accounts, though. “Studies show that the longer receivables go uncollected, the less likely they are to ever be collected, either partially or in full,” City National Bank explains.

“For that reason, your business will have the best chance of collecting if you are aware of any past due receivables and can act quickly.”

4. Reviewing Credit Terms

If you find that customers take a long time to pay, you may want to review your credit terms and consider changing them. Try reducing payment terms to 10 to 14 days on clients.

You should be cognizant of which clients are dependent on selling through before they can pay you back, however. It may be helpful to extend these terms as a courtesy.

It’s all about knowing your clients, how they operate, and what their payment history is. Tailoring credit terms to each client will help to keep the cash flowing.

Take Charge of Your Business

You simply can’t afford to be hands-off with accounts receivable. If you assume people will pay, your cash flow could quickly become strained.

It’ll end up compromising your accounts payable and your ability to manage payroll, inventory, marketing, and sales.

Take the time to revamp your strategy and come up with a proactive plan that maximizes efficiency and promotes greater profitability.