Hard money loans are a viable option for real estate investors. It is important to weigh all of the possible methods of financing in terms of potential benefits versus risk.

There is no simple solution, and not everyone will benefit in the same way. This is why conducting due diligence is so important for all borrowers. This simply means the process of obtaining information about the credibility of the lender before agreeing to the terms of the loan.

There are some similarities between traditional bank loans and hard money loans, but there are also significant differences as well. Understanding the terms of any loan is absolutely critical for investors who seek to get a favorable return on their investment.

Real Estate Financing Options

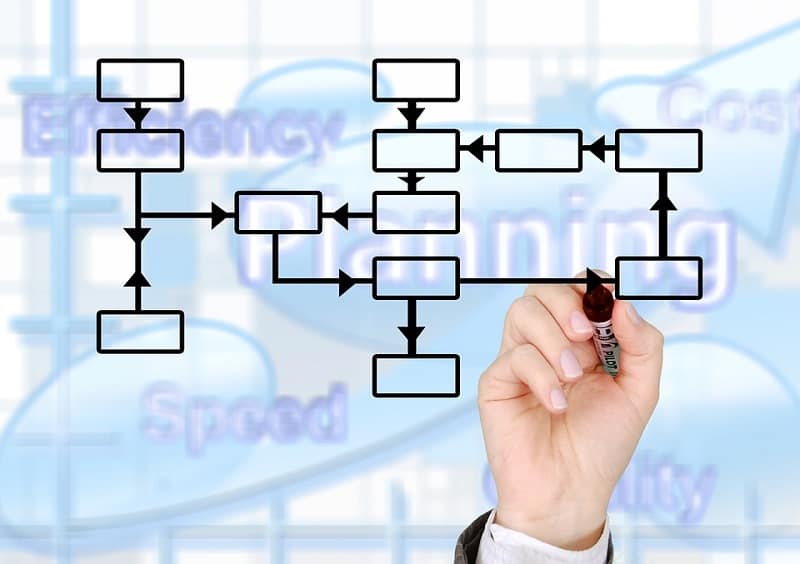

When real estate investors seek a loan from a traditional lending institution, they face a series of obstacles that might not apply when the same proposal is made to a hard money lender. For example, the banks typically require the borrower to provide documentation that is exhausting. This may include a business plan in some cases, but it can also mean providing extensive financial data, history of similar projects and related experience.

Some of these requirements are designed to discourage certain types of borrowing, which can inhibit investors from taking on these transactions. This is a real problem for a real estate investor who has already spent a lot of time and energy locating a great investment property. The building might not currently be in top condition, but a good investor will know that this can change.

According to Delancey Street, hard money lenders look at the same situation differently. These are lenders who will evaluate the proposal based on something called an after-repair value, or ARV. This means that these lenders understand how the real estate market works, and they will evaluate the prospects of the real estate based on the projected future returns. This can include a series of variables that banks would never even consider.

For example, if the neighborhood is planning to build a series of schools in the area, the housing value can be expected to rise in the future. This type of property would be evaluated by hard money lenders differently than the same property in the same condition would be appraised if it was in an economically depressed area.

Hard Money Loan Benefits

Conventional loans for mortgages have many potential drawbacks that are not shared with the loan terms offered by hard money lenders. For example, hard money loans often come with flexible repayment options, and the interest rate can be negotiated in many cases. The application process is also a lot more convenient, and the terms tend to be more favorable to the borrower. In addition, the approval process tends to be significantly faster than the process at a traditional lending institution.

Hard money loans are a good option for real estate investors who need to get approved quickly in order to get the property in shape for reselling. It is important for the borrower to conduct the proper amount of research before accepting the terms of any loan.

The interest rates will determine the total cost of borrowing the money, for example. If the borrower accepts terms that undermine the profit margin of the investment, this will be reflected on the investment portfolio, and this can affect future transactions.

You got me when you said that you can benefit from a hard money loan if you need your loan to be approved quickly. My uncle once told me that he’d like to buy some properties that he can use as an investment. He mentioned that he wanted to acquire the properties that he’s interested in ASAP since someone else might acquire them. Thanks for sharing this.

A hard money loan is a type of short-term real estate financing that allows to purchase properties, make necessary reviews and repairs, pay for other expenses and associated with real estate investing. Hard money loan serves a real market need because the most bank, credit unions, and traditional lenders won’t issue than due to their higher risk nature.