The foreign exchange market, also known as the forex or FX market, is the largest and most liquid financial market in the world.

It involves trading one currency for another at an agreed-upon price.

As a beginner in forex trading, it is essential to understand the basics of how this market works before diving into trading strategies.

Table of Contents

Understanding the Forex Market

The forex market is decentralized, meaning it has no central authority or physical location. Instead, it operates through a global network of financial institutions, including banks, corporations, and individuals. The trading activity in the forex market is open 24 hours a day, five days a week.

Trillions of dollars are traded daily in the forex market, making it highly liquid and volatile. This volatility presents a great opportunity for traders to profit, but it also carries significant risks.

Major Currencies and Pairs

There are many different currencies traded in the forex market, but some are more popular than others due to their stability and liquidity. These major currencies include the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD), and Australian Dollar (AUD).

In forex trading, currencies are traded in pairs, such as USD/CAD or EUR/JPY. The first currency in the pair is known as the base currency, while the second currency is called the quote currency. Each pair has a specific exchange rate that represents the value of one currency in terms of another.

How Forex Trading Works

Forex trading involves buying and selling currencies to profit from their fluctuations in value. When you buy a currency, you are essentially betting that its value will increase against the currency you are selling. If your prediction is correct, you can sell the currency at a higher price and make a profit.

However, if the market moves against you, you will incur a loss.

Forex trading can be done through various platforms and mediums, such as online trading platforms, mobile apps, or with the help of a broker. It is essential to choose a reliable broker who offers competitive pricing and good customer support to ensure a smooth trading experience.

Setting up a Forex Trading Account

To start trading in the forex market, you need to set up a trading account with a broker. Here are some factors to consider when choosing a broker:

- Regulation: Make sure the broker is regulated by a reputable financial authority.

- Trading Platform: Choose a platform that is user-friendly and has all the necessary features for your trading style.

- Spreads and Fees: Look for a broker with low spreads and reasonable fees to help maximize your profits.

- Customer Support: Good customer support is crucial, especially for beginners who may need assistance in navigating the platform or resolving issues.

Understanding Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of money. For example, if your broker offers 100:1 leverage, you can control a position of $100,000 with only $1,000 in your trading account. However, while leverage can amplify profits, it also increases the risk of losses.

Margin is the amount of money required to open a leveraged position. It acts as a security deposit that protects the broker from potential losses if your trade goes against you. It is essential to understand the concepts of leverage and margin and use them wisely in your trading strategy.

Forex Trading Strategies

There are various strategies that traders use to analyze the market and make informed decisions. Here are some of the most popular strategies used in forex trading:

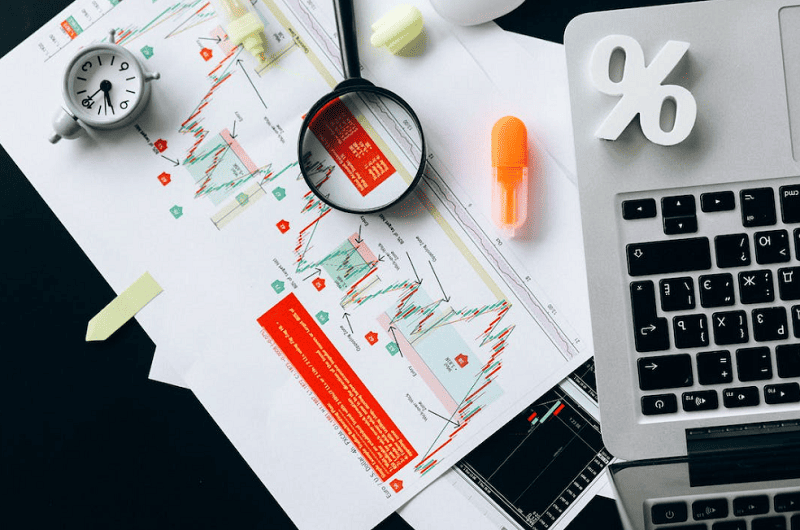

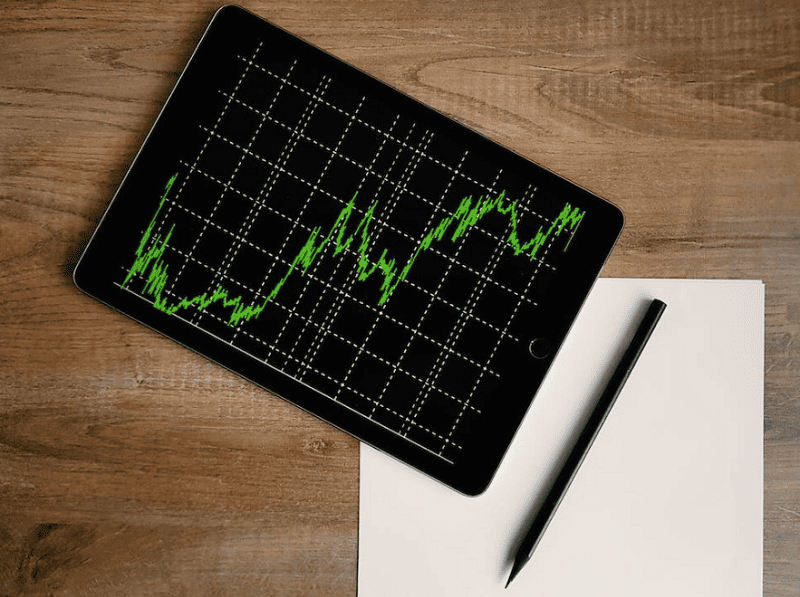

Technical Analysis

Technical analysis involves analyzing past price movements and patterns to predict future price movements. Traders use technical indicators, charts, and other tools to identify trends and potential entry and exit points. It is important to note that technical analysis does not consider the fundamental factors affecting the market.

Fundamental Analysis

Fundamental analysis looks at economic data, news events, and geopolitical factors that may impact a currency’s value. Traders using this approach analyze macroeconomic indicators such as inflation rates, employment data, and central bank policies to make trading decisions.

Sentiment Analysis

Sentiment analysis involves studying the overall market sentiment towards a particular currency or pair. It can help traders determine whether the majority of investors are bullish (expecting prices to rise) or bearish (expecting prices to fall).

Risk Management in Forex Trading

Managing risk is a crucial aspect of forex trading. It involves minimizing potential losses and protecting profits. Here are some risk management strategies to consider:

Stop-Loss Orders

A stop-loss order is an instruction to close a trade at a predetermined price level if the market moves against you. It helps limit potential losses in case of an adverse market move.

Position Sizing

Position sizing refers to determining the appropriate amount of capital to invest in a particular trade. It helps manage risk by limiting the overall exposure to any single trade.

Diversification

Diversifying your trades across different currencies and pairs can help reduce risk. If one trade performs poorly, others may still be profitable, thus minimizing potential losses.

Conclusion

Forex trading is an exciting and potentially lucrative market, but it is crucial to understand the risks involved and have a well-thought-out trading strategy. By following these forex trading tips for beginners and continuously educating yourself about the market, you can increase your chances of success in the world of forex trading. Remember to always trade responsibly and never risk more than you can afford to lose. So if you are a beginner, take your time to research and learn about the forex market before jumping into trading. With patience, discipline, and a solid understanding of the market, you can become a successful forex trader.