Debt has a bad reputation. Total household debt in the US now stands at $12.07 trillion, and many Americans are striving to reduce their personal debt. However, when used intelligently, debt can be a very useful financial tool.

For example, if you use debt to purchase a car to enable you to travel further for work and increase your earning potential, few would consider that debt a negative thing. There are times when using credit to make a big purchase that unlocks a higher earning potential will have a positive impact on your finances.

So, what lines of credit are available? And how can you use them intelligently to prevent the accumulation of ‘bad debt’?

Table of Contents

Personal Line of Credit

A personal line of credit is a popular avenue of credit. It often involves minimal waiting, with many lenders offering same-day approval. Personal lines of credit can be drawn on and used in any way you want. You will be required to make monthly installments or may be required to repay the line of credit in full in one lump sum before a predetermined deadline.

Your repayment schedule depends on the terms and conditions of your individual line of credit. Always make sure you are aware of the payment schedule and have calculated a budget to ensure you can make repayments on time before agreeing to the terms of a personal line of credit.

Personal lines of credit often have a relatively low fixed rate of interest. You also only pay interest on the money you use, unlike a loan. If you only use $300 of a $5,000 line of credit, you only pay interest on the $300. For more information, apply now at KingofKash.com.

Credit Cards

Credit card products function in a similar way to a personal line of credit. You receive a card and a credit limit. You may spend up to that credit limit without going over it and pay interest on the amount spent.

Credit cards often have cashback or rewards features, which means if you can find a credit card with rewards on travel or groceries, it may help you save money on those purchases in the long run. However, the drawback many borrowers find with credit cards is that the interest rates can be higher than other credit options.

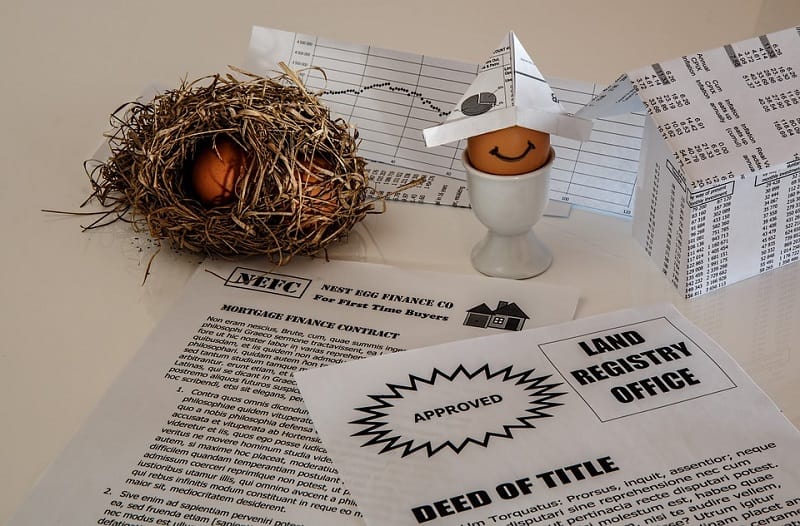

Home Equity Lines of Credit

Home equity lines of credit involve the borrower securing a line of credit using their property as collateral. This is advantageous for several reasons. Firstly, if the borrower has significant equity in their property, they can borrow a lot more. Interest repayments are also usually fairly low. Interest incurred can also be deducted from your taxes, for even more reductions.

However, there are drawbacks. Home equity lines of credits often come with closing fees, so it pays to read the small print on any contract before signing. The interest rates are also usually adjustable. This means if interest rates rise, the interest rate on your line of credit will rise.

However, there are drawbacks. Home equity lines of credits often come with closing fees, so it pays to read the small print on any contract before signing. The interest rates are also usually adjustable. This means if interest rates rise, the interest rate on your line of credit will rise.

Finally, putting your property up as collateral carries its own risk. If you fall behind on your payments, the borrower may have to sell their property to pay off the credit.