Finding the optimal balance between expanding your business and managing debt is crucial for achieving long-term success.

Understanding how to manage both effectively can prevent financial strain. Here is a comprehensive guide to help you navigate these challenges.

Table of Contents

Understanding the impact of debt on business growth

As a small business owner or entrepreneur, it is essential to understand how debt influences your growth prospects. Debt, when managed well, can provide necessary capital for expansion, but it also carries risks if not handled properly. It is therefore vital to know about solutions for managing business debt effectively, to ensure that you do not overextend your financial commitments. By clicking the link, you will find a list of ways to effectively manage your debt, which can provide the first steps of inspiration to help your business to further grow. It’s important to assess your debt levels regularly, ensuring they align with your cash flow and growth objectives. This understanding helps you make informed decisions that support sustainable development.

When evaluating the impact of debt, it’s crucial to consider both short-term and long-term consequences. Short-term debt can provide quick capital for immediate opportunities, but it may come with higher interest rates and more stringent repayment terms. Long-term debt, while often offering lower interest rates, can affect your company’s financial flexibility over an extended period. By carefully analyzing the cost of capital against potential returns, you can make strategic decisions about when and how to leverage debt for growth. Remember, a healthy debt-to-equity ratio is key to maintaining investor confidence and accessing future funding when needed.

Creating a strategic plan for balancing growth and repayment

Developing a strategic plan that integrates both growth initiatives and debt repayment strategies is fundamental to maintaining financial health. This involves setting clear priorities that balance investment in new opportunities with the need to reduce existing liabilities. By mapping out a detailed budget and cash flow projections, you can identify areas where costs can be minimized or revenues increased. It’s also advisable to explore diverse financing options that offer flexibility in repayment terms, which can be particularly useful during fluctuating market conditions.

An effective strategic plan should also incorporate scenario planning to prepare for various economic situations. This involves creating multiple financial models that account for best-case, worst-case, and most likely scenarios. By doing so, you can develop contingency plans that allow for quick adjustments in your debt management and growth strategies. Additionally, consider implementing a debt snowball or avalanche method, where you focus on paying off either the smallest debts first for psychological wins or the highest-interest debts first for maximum financial benefit. Regularly revisiting and adjusting your plan ensures it remains aligned with your evolving business needs and market conditions.

Exploring financial resources and implementing efficient operational practices

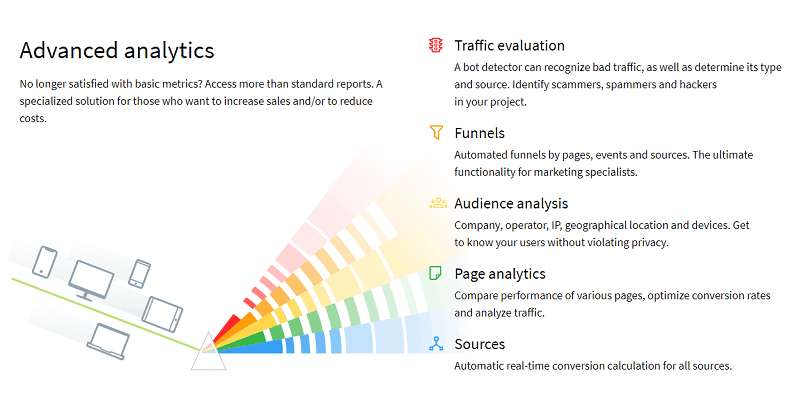

In today’s dynamic business environment, having access to the right financial tools and resources is crucial for effective debt management. Many online platforms offer valuable insights into financial planning, providing templates and calculators to assist in creating realistic budgets. Leveraging technology can also enhance your ability to monitor expenses and track progress against your financial goals. Regularly reviewing these resources ensures that you are up-to-date with best practices and innovative solutions available in the market.

The efficiency of your business operations significantly affects your ability to manage debt while pursuing growth. Streamlining processes can lead to cost savings, which can be redirected toward debt reduction or reinvested into the business. Emphasizing productivity improvements not only enhances profit margins but also provides more stability during periods of economic uncertainty. Collaborating with industry experts or joining professional networks can offer new perspectives and strategies that align with your specific business needs.