Trading is an ever-changing and dynamic industry. It involves buying and selling financial instruments such as stocks, bonds, currencies, commodities, and derivatives.

Traders aim to profit from the fluctuations in the prices of these assets by making well-informed decisions based on market analysis.

In this document, we will discuss some general trading tips that can help you navigate the complex and volatile world of trading.

Table of Contents

1. Educate yourself

The first and most important tip for any trader is to educate themselves about the financial markets. This involves understanding how different asset classes work, learning about various trading strategies, using an online trading journal, and keeping up-to-date with current events that can affect the markets.

There are many resources available online, such as books, articles, and educational videos that can help you gain a better understanding of trading. You can also attend seminars or workshops to learn from experienced traders. Choosing the best trading journal software to track your progress and analyze your trades is also crucial in improving your trading skills.

2. Set realistic goals

Before you start trading, it’s important to set realistic goals for yourself. Your goal should be specific, measurable, achievable, relevant, and time-bound (SMART). This will help keep you focused and motivated.

It’s also essential to have a clear idea of your risk appetite and how much you are willing to invest. Don’t let emotions like greed or fear cloud your judgment, as they can lead to impulsive and irrational decisions.

3. Practice with a demo account

Many trading platforms offer demo accounts where you can practice trading without risking real money. This is an excellent way to test different strategies and get a feel for the market before you start trading with real money.

4. Keep track of your trades

It’s essential to keep track of your trades, including entry and exit points, profit/loss, and any other relevant information. This will help you analyze your performance over time and identify patterns or areas where you can improve.

5. Diversify your portfolio

A common mistake that traders make is putting all their eggs in one basket. It’s crucial to diversify your portfolio by investing in different assets, sectors, and geographical regions. This helps reduce risk and protect against market volatility.

6. Use stop-loss orders

A stop-loss order is a type of order that automatically closes a trade if the price of an asset reaches a certain level. This can help limit your losses in case the market moves against you.

7. Don’t chase trades

It’s essential to have discipline and not chase trades based on emotions or FOMO (fear of missing out). Stick to your trading plan and only enter a trade when your analysis supports it.

8. Keep emotions in check

Trading can be a rollercoaster of emotions, but it’s crucial to keep them in check. Successful traders make decisions based on logic and analysis, not emotions like fear or greed.

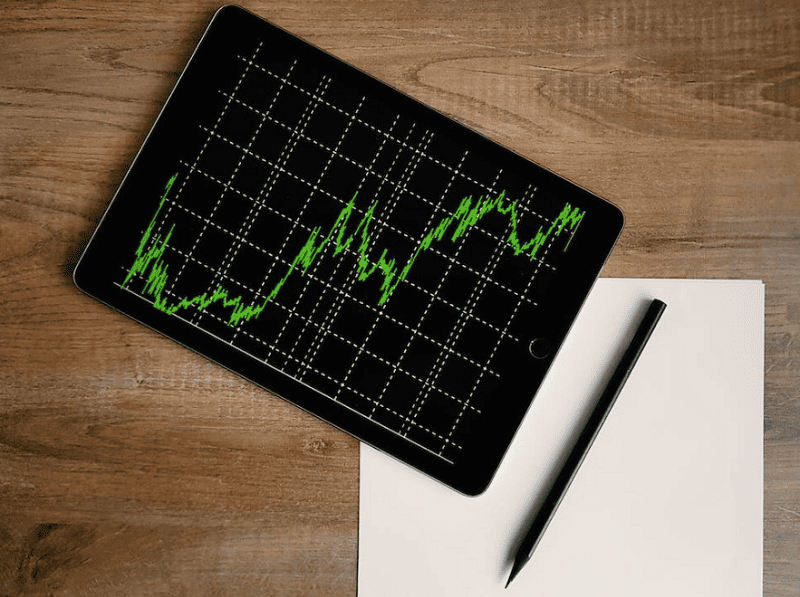

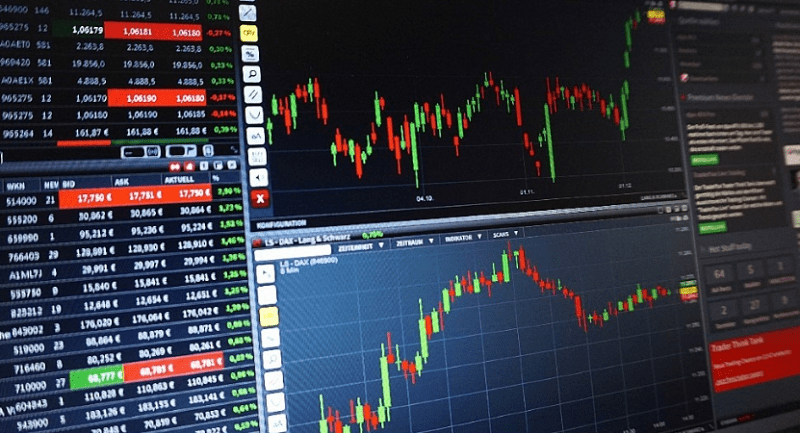

9. Continuously monitor the markets

The financial markets are constantly changing, so it’s essential to stay updated and monitor them regularly. This will help you spot potential opportunities or risks and make informed decisions.

10. Learn from your mistakes

Trading is a learning process, and it’s normal to make mistakes along the way. What’s important is that you learn from these mistakes and use them to improve your trading skills.

Takeaways

In conclusion, trading requires a combination of knowledge, discipline, and continuous learning. By following these tips, you can enhance your chances of success in the trading world. Remember to always stay informed, set realistic goals, practice with a demo account, and keep emotions in check.

Educating is beyond key for setting the tone investment-wise. When I traded stocks I recall reading Investor’s Business Daily every weekend, very closely, to be informed. Ditto for my forex trading campaign way back in the day. I did extensive due diligence to be confident in my decisions. Smart post.

Ryan