Proprietary trading, also known as prop trading, is the act of buying and selling financial assets using a firm’s funds rather than on behalf of clients. In this type of trading, firms use their capital to speculate in the markets to generate profits.

Table of Contents

Definition and Overview

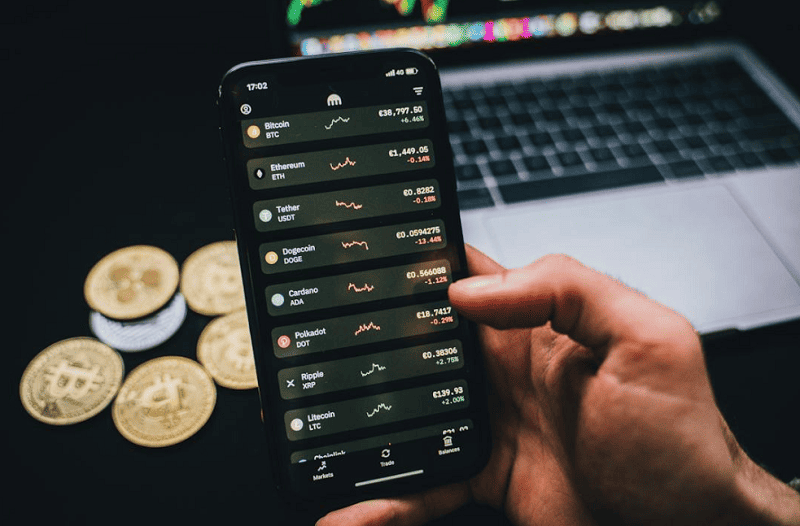

Proprietary trading involves leveraging a firm’s capital to trade financial instruments, such as stocks, bonds, commodities, currencies, or derivatives. Unlike traditional trading where brokers act on behalf of clients, proprietary traders make decisions and execute trades using their funds. This gives them more autonomy and control over trading strategies and allows for faster decision-making.

Historical Context

Proprietary trading has been around since the early 19th century when private partnerships and merchant banks started using their funds to invest in the stock market. However, it gained popularity in the late 20th century with the rise of electronic trading and increasing competition among financial firms.

How Proprietary Trading Works

Proprietary trading works by leveraging a firm’s capital to generate profits through buying and selling financial assets. Traders use various strategies, including technical and fundamental analysis, to identify profitable trades.

Basic Mechanism

In proprietary trading, firms allocate a certain amount of capital to traders who then use this fund to speculate in the markets. Traders can use leverage, or borrowed funds, to amplify their trading positions and increase potential profits. They also have access to advanced trading tools and technologies, such as algorithmic trading, to execute trades quickly and efficiently.

Risk Management Strategies

Since proprietary trading involves using a firm’s capital, risk management is crucial. Traders use various risk management strategies, such as diversification and hedging, to minimize potential losses. They also closely monitor market trends and adjust their positions accordingly.

Key Players

In proprietary trading, key players include traders, analysts, and risk managers. Traders are responsible for making investment decisions and executing trades, while analysts provide research and insights to support trading strategies. Risk managers oversee the firm’s overall exposure to market risks and ensure that proper risk management measures are in place.

Types of Proprietary Trading

There are various types of proprietary trading strategies used by firms to generate profits.

Arbitrage

Arbitrage involves taking advantage of price discrepancies in different markets or assets. For example, a trader may buy a stock on one exchange and sell it on another at a higher price, making a profit from the difference.

Swing Trading

Swing trading is a short-term trading strategy that involves buying and selling financial assets within a few days or weeks. Traders use technical analysis to identify short-term price swings and take advantage of them.

Index Fund Trading

Index fund trading involves investing in index funds, which are portfolios of stocks that track a specific market index. Traders can engage in index fund trading to benefit from the overall performance of the market.

Benefits of Proprietary Trading

Proprietary trading offers various benefits for firms and traders.

Potential for High Returns

Since proprietary traders use leverage and have access to advanced tools, they have the potential to generate high returns. This can result in significant profits for firms and traders.

Independence in Decision-Making

Unlike traditional trading where brokers make investment decisions on behalf of clients, proprietary traders have more autonomy and control over their trading strategies. They can make decisions based on their research, analysis, and risk appetite.

Access to Advanced Tools and Information

Proprietary traders have access to advanced trading tools, technologies, and information that are not available to retail or traditional traders. This gives them a competitive edge in the market.

Challenges Associated with Proprietary Trading

While proprietary trading offers various benefits, it also comes with its own set of challenges.

High Risk

Proprietary trading is inherently risky as traders use leverage to amplify their positions. This can result in significant losses if trades do not go as planned.

Regulatory Concerns

Due to the potential risks associated with proprietary trading, there are strict regulations in place to ensure that firms and traders follow risk management practices and comply with laws.

Conclusion

In conclusion, proprietary trading is an important aspect of the financial market that offers benefits for firms and traders. With its potential for high returns and access to advanced tools, more firms are engaging in this type of trading. However, it also comes with its own set of challenges, such as high risk and regulatory concerns. As with any type of trading, proper risk management and compliance are crucial for success in proprietary trading.