Fintech, the convergence of finance and technology, is reshaping the financial landscape by offering innovative solutions to everyday financial challenges. Companies such as Cane Bay Partners demonstrate the power and potential of fintech by integrating cutting-edge technologies and predictive analytics into their financial frameworks. This integration not only brings efficiency but also enhances the user experience by providing smarter, more intuitive tools for financial management. The science behind fintech delves into creating systems that adapt to the user’s financial habits, ultimately guiding them toward better decision-making.

Cane Bay’s fintech consulting services help companies stay ahead in the fast-paced financial world. Based in the Virgin Islands, they deliver tailored solutions in analytics and strategy. Clients appreciate their hands-on approach and measurable results.

Table of Contents

The Role of Data Science in FinTech

Data science serves as the cornerstone of fintech, empowering organizations to harness vast amounts of data for strategic insights and trend forecasting. By analyzing consumer behavior data and market conditions, fintech companies can offer personalized financial products that cater to individual needs. Such personalized services improve customer satisfaction and loyalty by providing services tailored to specific financial situations. As reported by Forbes, the use of data science in fintech results in more accurate financial predictions and actionable insights, proving essential for both consumers and businesses alike. With data analytics, fintech can address consumer needs more precisely, fostering a deeper connection with users through customization and relevancy.

Machine Learning and Algorithmic Trading

Machine learning, a subdivision of artificial intelligence, is revolutionizing financial trading through the use of algorithmic trading systems. These sophisticated systems employ historical and real-time data analytics to identify optimal trading opportunities, minimizing risks while maximizing returns. The adaptability of machine learning algorithms allows them to continuously learn from data patterns and adjust strategies accordingly, ensuring that traders remain competitive in increasingly volatile markets. The speed and accuracy provided by algorithmic trading mean traders can execute large volumes of transactions in microseconds, a feat unattainable in traditional trading setups. This technological advancement is crucial for maintaining an edge in today’s fast-paced financial markets.

Blockchain: Beyond Cryptocurrencies

Blockchain technology, often synonymous with cryptocurrencies, holds the potential to secure various applications within the fintech sector. This technology offers a decentralized and transparent way to record transactions, thus ensuring data integrity and trust among users. The immutable nature of blockchain ledgers means that any transaction or data entry is permanently recorded and auditable, eliminating the risk of fraud and errors. Beyond this, blockchain’s applications extend into industries such as supply chain management, where it can track products in real-time from origin to consumer, ensuring authenticity and adherence to standards. This technology is poised to redefine how transactions are managed and validated across numerous sectors.

FinTech Innovations in Personal Finance

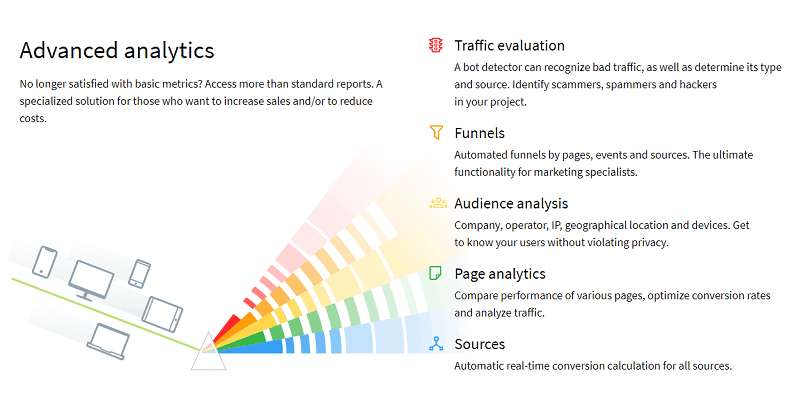

Fintech has introduced many innovations aimed at simplifying user personal finance management. With tools such as budgeting apps, robo-advisors, and investment platforms, FinTech enables users to automate tasks and make informed financial decisions. These tools streamline the financial management process and provide users with personalized advice and insights based on their spending and saving patterns. According to a study by CNBC, fintech applications are significantly improving how individuals save money and transform their financial literacy, allowing users to achieve their monetary goals more efficiently.

Cybersecurity and FinTech: A Double-Edged Sword

As fintech continues to infiltrate daily life, the need for robust cybersecurity measures becomes increasingly critical. With the enormous amount of sensitive data flowing through these platforms, fintech companies must prioritize protecting their systems from breaches and other cyber threats. Biometric authentication, end-to-end encryption, and advanced firewalls are among the strategies being implemented to safeguard user data. However, this focus on security must not impede user accessibility or convenience, posing a unique challenge in the fintech ecosystem. Effective cybersecurity ensures consumer trust and helps maintain the integrity of financial services in an age of digitalization.

Ethical Considerations in FinTech

Ethical challenges in fintech often arise when balancing innovation with user protection. Companies must navigate privacy concerns and ensure their technologies are inclusive, providing equal access to all individuals regardless of socioeconomic status. Transparency in operations and fair practices in lending and investment are vital components of maintaining ethical standards. Furthermore, as AI-driven technologies become more prevalent, it’s essential that fintech firms consider biases that may arise in decision-making processes, ensuring that tech benefits all users equally. Addressing these ethical concerns is crucial for fostering trust and ensuring the long-term success of fintech products.

The Future of FinTech: An Open Horizon

The future of fintech looks promising as emerging technologies, such as artificial intelligence and quantum computing, hold the potential to push boundaries even further. These innovations will likely lead to more sophisticated and personalized financial services, optimizing them for accessibility and greater user satisfaction. As these technologies develop, fintech is expected to become seamlessly integrated into everyday activities, simplifying financial management to an unprecedented degree. As a result, both businesses and consumers will benefit from enhanced financial performance, convenience, and the ability to adapt to ever-changing economic landscapes.