As we age, our financial situation changes. Retirement planning becomes more critical and investing strategies may need to be adjusted.

People over the age of 60 have unique financial needs that must be addressed to ensure a comfortable retirement.

In this article, we’ll discuss ten essential financial tips for individuals over 60 years old.

Table of Contents

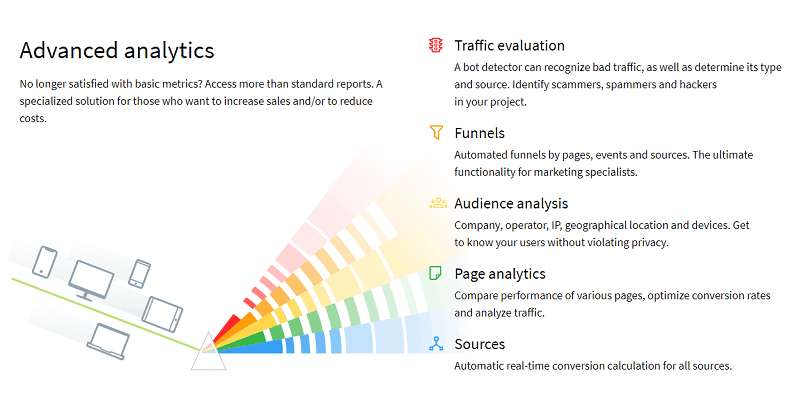

Tip #1: Use a financial service

Managing finances can be challenging, especially as we age. It’s crucial to seek the help of a financial service company like Charlie Finance to ensure your finances are handled correctly.

Financial service companies can provide valuable advice on budgeting, investment strategies, and retirement planning.

Tip #2: Review your insurance coverage

At 60 years old, you may be eligible for Medicare or will soon be eligible. It’s essential to review your insurance coverage to make sure it aligns with your current needs and budget.

You may also want to consider long-term care insurance and other policies that can provide financial protection in the event of unexpected medical expenses.

Tip #3: Evaluate your investment portfolio

As you get closer to retirement, it’s crucial to evaluate your investment portfolio and make adjustments as needed.

It may be wise to shift towards more conservative investments that provide stability and income rather than high-risk, high-reward options.

Tip #4: Maximize your retirement contributions

If you are still working, take advantage of catch-up contributions allowed for individuals over 50 years old.

These additional contributions can help boost your retirement savings in the final years before retirement.

Tip #5: Pay off debt

Entering retirement with significant debt can put a strain on your finances.

Before retiring, try to pay off as much debt as possible, such as credit card balances or loans. This will alleviate financial stress and allow you to budget your income more effectively during retirement.

Tip #6: Consider downsizing

Downsizing your home can be a smart financial decision in retirement. It can reduce housing expenses and free up cash for other needs.

Plus, having a smaller, more manageable space can also save on maintenance and utility costs.

Tip #7: Plan for unexpected expenses

Even with careful planning, unexpected expenses can arise in retirement. It’s essential to have an emergency fund set aside to cover unexpected costs, such as home repairs or medical bills.

Tip #8: Be cautious of scams

Unfortunately, older adults are often targeted by scammers. It’s crucial to be cautious and educate yourself on common scams targeting seniors.

Never give out personal information over the phone or email, and always verify any requests for money or sensitive information.

Tip #9: Consider working part-time

Many individuals over 60 continue to work in some capacity during retirement. Not only can this provide additional income, but it can also help keep your mind sharp and provide a sense of purpose.

Tip #10: Seek financial advice

Lastly, it’s essential to seek financial advice from a trusted professional. A financial advisor can help you create a comprehensive retirement plan and make informed decisions about your finances.

Conclusion

Retirement planning can seem overwhelming, especially as we age. However, by following these ten financial tips for individuals over 60 years old, you can set yourself up for a more comfortable and worry-free retirement.

Remember to stay on top of your budget, review insurance coverage, evaluate investments, and seek professional advice to ensure a secure financial future. So, it’s never too late to start planning for retirement!

Whether you are currently over the age of 60 or approaching this milestone, taking these steps toward financial preparedness can help you confidently enter your golden years.