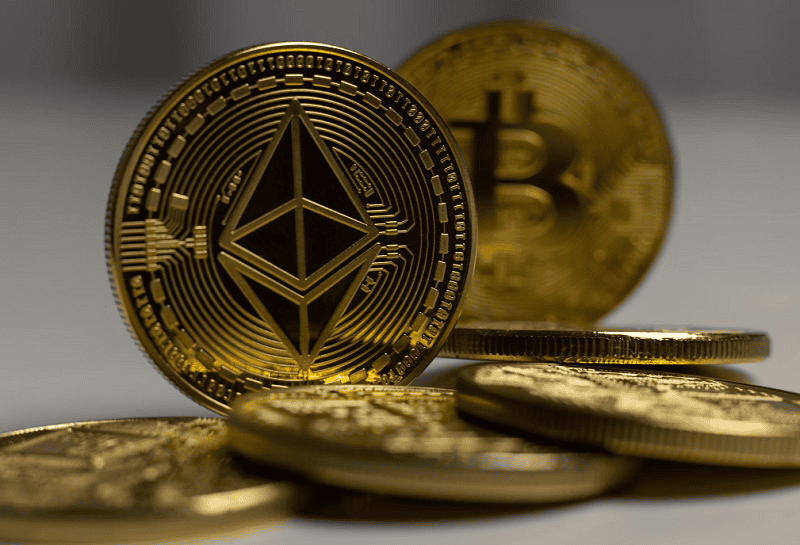

After two years of underperformance, Ethereum soared from the very beginning of 2024, regaining much of its previously lost value and consolidating its position as the most powerful altcoin on the market. However, corrections were bound to happen, with historical data indicating that this is the general way in which the market operates during the growth cycles. Although the losses might seem detrimental from an outsider’s perspective, they are vital for the well-being of the market and investors, as the prices growing indefinitely is an unsustainable scenario. However, if consolidation takes place over an extended period of time, it can result in losses.

Although the current cycle is not expected to be as troublesome as its predecessors, investors and analysts nonetheless keep a close eye on the Ethereum price chart and estimate that it will take some time for the market to recover completely. That is precisely why having a sound strategy that leaves plenty of room for movement and change remains paramount.

Services that let you buy bitcoin with Revolut bridge the gap, offering a reliable gateway for seamless cryptocurrency transactions.

Table of Contents

Resistance

Much like in the rest of the financial world, the resistance level in the crypto ecosystem is the price zone where an asset experiences considerable selling pressure and is, therefore, hindered from climbing above. Historical data, pivot levels and trendlines are some of the most common indicators that can help in determining the support levels. At the moment, Ethereum is dealing with pressure around the $3,600 level, showing that there are still barriers on the asset’s path to success. Traders monitoring currency pair conversions such as EUR to ETH often use these same resistance insights to gauge the optimal entry or exit points when moving between fiat and crypto.

The In/Out of the Money Around Price, commonly referred to as the IOMAP, is an indicator that covers some of the most relevant price clusters within 15% of the price in both directions. The measurements are meant to show the key selling and buying areas that should act as both resistance and support. Data gathered from the IOMAP can be used to make estimations about the current market as well. So far, the figures indicate that the resistance area is positioned somewhere between $3,534 and $3,639. That represents a pretty hefty area, with roughly 1.7 million addresses holding about 4.97 million Ether coins.

Depending on whether this area records a high activity volume from the sellers in the short term, the price should sink even further, begin climbing back up again, or stagnate.

Bearish tendency

The Bitcoin halving of 2020 ushered in the beginning of one of the most intense crypto rallies in the market’s entire history. Although Ethereum and the altcoins operate as entirely separate digital entities, they were nonetheless affected by the changes as well and grew tremendously throughout 2021. During this time, many crypto coins reached their all-time high levels, and the market performed better than it had done in a very long time.

What followed in 2022 was a downtrend that matched the initial optimism and growth in sheer magnitude, causing many coins to lose considerable portions of their value. Following that moment, investors have been focused on growth and development, hoping the environment will recover quickly. Unfortunately, this wasn’t the case, and even the 2023 marketplace was ultimately disappointing, causing more stagnation and uncertainty than growth.

2024 also started off strong but is now going through a correction episode. On March 12th, ETH reached a 27-month high level, standing at $4,093, a considerable performance and a sign of a strong rally. The price then fell but managed to recover, signaling to investors and researchers that the current trading environment is considerably more robust and mature compared to the ones that came before. Nevertheless, most investors are convinced that the bullish tendency has calmed down a little in the Ethereum environment, at least for the time being.

The bearish trend has appeared on the daily chart already, and there are indications that it will continue unperturbed for a little longer, something many investors are probably not keen on. It’s clear that some of them are also disappointed, considering the fact that ETH has only managed to escape a similar market tendency not long ago. Moreover, most investors believe that the current market is unlikely to bring along the same destruction that the bear market of 2022, and most consider their assets and portfolios to be completely safe and sound.

The bulls are relying on the support of the lower boundary, somewhere around $3,497. The RSI shows that the bears were selling to $3,600 on the latest rally. If the daily candlestick closes below the $3,497 level, it will indicate a clear bearish breakout. Since the crypto market remains volatile compared to its more traditional peers, it is not yet sure how the situation will evolve, hence why it is essential for investors to remain aware of the changes occurring in the trading environment.

Further decentralization

Decentralization is the fundamental feature of the Ethereum space, the reason why most investors flocked to crypto assets in the first place. Yet, concerns about possible centralization have ranked high among investor worries over the past year. Since the Merge and Shanghai have made staking and withdrawing a reality, investors have been increasingly concerned about its potential to centralize the market.

While the initial concerns involved predictions that said the amount of withdrawals will destabilize the market, the opposite has happened, and after an initial surge in withdrawals, investors began staking in record numbers. This has also reduced the staking yield and caused some to wonder if some validators are not getting an unfair advantage compared to other market users. Recently, Vitalik Buterin released a blog post addressing these concerns specifically while also presenting the trading environment with a potential solution.

He suggested placing sanctions on validators depending on their annual failure rate, and in case several of them fail together, they ought to receive a higher penalty compared to a situation in which they all failed independently. The idea here is that if a validator is disproportionately large, the mistakes they make could be replicated across all the different identities they are in charge of.

To sum up, the Ethereum market is enjoying much better performance this year, but the future is still uncertain as far as consolidation is concerned. If you’re an investor, steer clear of any trading activity that seems too risky, as it can cause far more losses than gains.