Within the realm of personal finance, credit cards present a special chance since they can be used as a means of obtaining incentives in addition to serving as a convenient means of credit.

In essence, these rewards let customers make money as they spend it. They might be anything from cash back to travel benefits. But occasionally, the allure of these advantages might trick people into falling into the trap of accruing unneeded debt. To maximize credit card rewards, use them wisely.

Don’t let the chase for rewards harm your finances. If you’re interested in exploring how to leverage such rewards for entertainment, consider reading this article: https://euroweeklynews.com/2024/08/28/a-comprehensive-guide-to-navigating-hell-spin-casino-features-gameplay-and-more/, which offers insights on features, gameplay, and more.

Table of Contents

Strategies to Maximize Rewards

Pay Off Balances Each Month

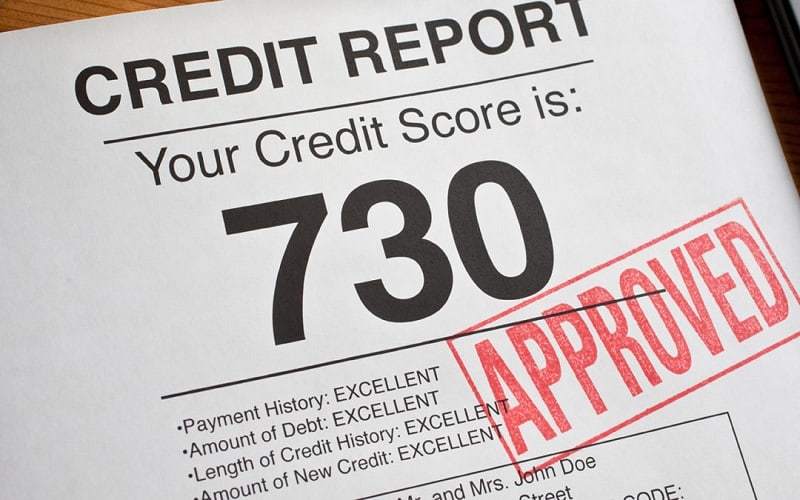

Making complete monthly credit card payments is the best way to optimize rewards without taking on debt. This method guarantees you won’t pay interest. It might quickly offset the value of any benefits you get. By lowering your credit utilization, holding a zero balance also helps you raise your credit score.

Use Your Card for Everyday Purchases

Use your rewards card for everyday spending like gas, groceries, and bills to get the most out of it. These are costs you would have to pay for anyhow. This approach facilitates rapid reward accumulation without incentivizing unnecessary expenditure.

Take Advantage of Sign-Up Bonuses

There are sign-up bonuses for many credit cards, and they may be very profitable. Spending a certain amount during the first few months of creating your account is typically required to qualify for these benefits. To fulfill these bonus requirements without going over your usual spending limit, schedule significant purchases or bill payments around your new credit card.

Be Aware of Bonus Categories

Certain credit cards provide extra benefits in specific areas, such as eating, grocery, or vacation. To get the most points, keep an eye on these categories and arrange your expenditure appropriately. But it’s important to avoid overspending in order to obtain rewards.

Redeem Rewards Wisely

Make the finest value selections when it comes time to redeem your awards. Certain cards, for instance, have higher redemption rates for travel than for cash back. Understand the reward system on your card and schedule redemptions according to your needs and lifestyle.

Avoiding the Debt Trap

Overspending is an easy trap to slip into while chasing rewards. Make sure you adhere to a rigorous monthly budget for your credit card spending in order to prevent this. Watch your accounts. Ensure you stay within your spending limit. Adjust your spending if needed.

Integrating Rewards into Larger Financial Goals

Your overall financial tactics should be complemented by credit card incentives. For example, if you have a credit card that offers travel rewards, you can use it to lower the cost of your vacation. You might also use a rewards card for hobby-related purchases. For example, the chance to Play Roulette at Hell Spin Casino could earn you extra points. Using a card linked to gaming purchases might help. This is especially useful if you’re an enthusiastic gamer or love online entertainment.

In conclusion, if used wisely, credit card rewards can be an effective tool for managing your finances. You can enjoy major perks without debt. Just choose the right card, pay your balances on time, and plan your purchases and redemptions. Recall that the objective is to make your money work for you rather than letting alluring benefits trap you in debt.