The allure of homeownership is undeniable, but the path to property ownership requires careful financial planning. Budgeting is the cornerstone of this journey, providing a roadmap to navigate the complexities of saving, spending and investing for your future home.

Table of Contents

Understanding Your Financial Landscape

Before diving into the home-buying process, it’s essential to take a close look at your current financial situation. Start by evaluating your income, expenses, savings and any outstanding debts. Understanding your financial standing will give you a clear picture of how much you can afford to spend on a home.

Conduct a meticulous review of your spending over a three-month period, categorizing expenses into essential needs like housing and utilities, discretionary items such as dining out and entertainment, and debt obligations. This exercise offers invaluable insights into your spending patterns, revealing areas where adjustments can be made to maximize savings.

Navigating Mortgage Options

The mortgage market offers a variety of options, each with its own set of terms and requirements. Carefully evaluate interest rates, down payment expectations and loan lengths to select the mortgage that best aligns with your financial goals.

For individuals seeking to purchase a property that requires renovations, a 203k loan may be an attractive option. This government-backed loan provides financing for both home purchases and necessary repairs. To determine who qualifies for a 203k loan, consult with a mortgage lender for personalized guidance.

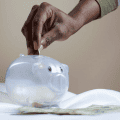

Building a Strong Financial Foundation

Saving diligently is paramount for achieving homeownership. Aim for a substantial down payment of 20% to optimize your mortgage terms, but remember that even smaller initial investments can be a significant step forward.

Consider high-yield savings accounts to accelerate your progress and explore additional savings avenues like IRAs or 401(k) plans. Every dollar saved brings you closer to realizing your homeownership dream.

Tackling Debt for Financial Freedom

High levels of debt can pose obstacles to mortgage approval and increase overall housing costs. Prioritize eliminating high-interest credit card debt and personal loans.

If overwhelmed by debt, consider debt consolidation strategies to streamline repayment and potentially lower interest rates. Improving your credit score is essential for securing favorable mortgage terms, so focus on consistent and responsible financial management.

Crafting a Realistic Budget

With a clear understanding of your income and expenses, create a detailed budget that outlines your financial commitments. Allocate funds for housing costs encompassing mortgage payments, property taxes, homeowners insurance and potential homeowners association fees.

Don’t overlook essential expenses like utilities, maintenance costs and the importance of establishing an emergency fund to address unexpected home-related challenges.

Setting Achievable Financial Goals

Define clear and attainable financial goals that align with your homeownership aspirations. Establish a target savings amount for your down payment, create a timeline for debt repayment and outline your ideal home features.

Regularly review and adjust your goals as needed to stay on track. Celebrating small milestones along the way can help maintain motivation and focus.

Building a Financial Safety Net

In addition to saving for a down payment, creating a robust emergency fund is crucial.

Aim to accumulate three to six months’ worth of living expenses to safeguard against unforeseen financial setbacks such as job loss or major home repairs.

This financial cushion provides peace of mind and protects your homeownership journey.

Seeking Expert Guidance

Enlisting the expertise of financial advisors or real estate agents can offer invaluable support. These professionals can help create a personalized financial plan, assess your homebuying readiness and guide you through the complexities of the mortgage process. Their knowledge and experience can be instrumental in achieving your homeownership goals.

Remember, homeownership is a significant financial undertaking. By implementing sound budgeting strategies, making informed financial decisions and seeking professional guidance, you can increase your chances of successfully realizing the dream of owning a home.

Take Control of Your Financial Future

Ready to embark on your homeownership journey? Download a free budgeting worksheet to kickstart your savings plan. Or, connect with a local real estate agent to discuss your housing goals and explore available properties. Don’t let the dream of homeownership remain just a dream – take the first step towards achieving it today!