In today’s volatile economic landscape, the art of personal finance and business budgeting has never been more critical – or complex. With the right budgeting app, the once-formidable task of tracking expenses, managing cash flows, and forecasting financial futures becomes not only manageable but, dare we say, slightly enjoyable.

For Millennials navigating the intricacies of adulthood and small business owners juggling myriad operational expenses, every dollar counts. The digital sphere is teeming with budgeting apps vying for your attention, each touting its unique blend of features that promise to revolutionize your financial management strategies.

But which app is best suited for your specific needs? Fear not, as we take you on a comprehensive tour of the best budgeting apps on the market, empowering you to make an informed decision that aligns with your financial goals.

Table of Contents

Defining Your Budgeting Goals

Before we plunge into the deep waters of budgeting applications, it’s crucial to establish your financial objectives. Are you aiming to save for a downpayment on your first home? Interested in tracking every cent to optimize personal spending? Or maybe you’re running a small business and need to keep a tight grip on your finances. In that case, it’s also helpful to understand the basics of your business structure, like What is a Limited company? as it can significantly affect how you manage costs and liabilities.

Identify Personal or Business Objectives

- For personal finance, pinpoint whether you’re aiming to save, invest, or simply become more aware of your spending.

- In the business realm, assess whether you need to prioritize cost control, manage multiple accounts, or track project expenses.

Determine the Level of Automation Required

- Some users prefer hands-on manual tracking, while others covet the convenience of automated categorization and notifications.

Assess the Need for Reporting and Analysis

- Will you require in-depth financial reports and trend analysis, or are you looking for a more simplified overview of your financial status?

Reviewing the Leading Budgeting App Contenders

With our goals firmly in mind, it’s time to evaluate your potential digital allies in the world of budgeting. Here are the leading budgeting apps renowned for their unique strengths:

Mint – The OG All-Rounder

- Favored for its robust and completely free service, Mint offers a comprehensive view of your financial health, with features ranging from bill tracking to credit score checks.

You Need A Budget (YNAB) – The Proactive Planner

- YNAB is lauded for its zero-based budgeting approach, where every dollar earns a job. This app is ideal for those who crave control and wish to allocate funds with precision.

Personal Capital – The Investment Integration

- Targeting individuals with a penchant for personal finance management and investments, Personal Capital integrates budgeting with portfolio tracking and retirement planning.

EveryDollar – The Dave Ramsey Affiliation

- Built on the principles of financial guru Dave Ramsey, EveryDollar emphasizes budgeting to zero along the lines of YNAB but with a slightly simpler interface.

QuickBooks – The Small Business Stalwart

- QuickBooks caters to the more complex financial needs of small businesses, offering robust invoicing, expense tracking, and tax preparation functionality.

Wally – The Sleek and Simple

- Best-suited for those who enjoy a minimalist interface and a straightforward approach to tracking expenses, Wally keeps budgeting pleasantly uncomplicated.

Zoho Books – For Growing Business Financials

- With scalable features, Zoho Books provides unique solutions for growing businesses, incorporating inventory management and seamless payment tracking.

Understanding the Nuts and Bolts of Each App

Now that we’ve outlined the top contenders, it’s time to peel back the layers and examine the core functionality and user experience of each budgeting app more closely.

Mint’s Automated Tracking and Categorization

- Analyze how Mint’s automatic expense tracking and categorization can demystify your spending habits and offer personalized savings tips.

YNAB’s Rule-Based Budgeting Philosophy

- Explore YNAB’s four rules and how they translate into a more informed, controlled, and intentional way to manage your money.

Personal Capital’s Investment Portfolio Insights

- Discover how Personal Capital’s tools can help you manage your investment accounts, plan for retirement, and gauge the performance of your portfolio.

EveryDollar’s Simplicity and Ramsey’s Principles

- Delve into how EveryDollar adheres to the principle of every dollar having a role while maintaining a user-friendly design.

QuickBooks’ A to Z of Business Financials

- Uncover the ways in which QuickBooks offers small business owners extensive tools for invoicing, employee management, and even tax preparations.

Wally’s Effortless Expense Tracking

- Learn how Wally can simplify the otherwise Herculean task of tracking your spending with a few taps on your smartphone.

Zoho Books’ Scalability for Growing Ventures

- Understand how Zoho Books’ scalable nature caters to small businesses that are expanding their operations and financial management needs.

Tailoring Your Choice to Fit Your Lifestyle or Business Model

Each budgeting app boasts characteristics that may resonate with specific lifestyles and business models. It’s time to refine your shortlist by ensuring compatibility with your day-to-day operations and long-term aspirations.

Considering User Interface Preferences

- Do you prefer a sleek, modern interface that focuses on actionable insights, or are you more drawn to a traditional layout that provides a comprehensive financial snapshot?

Integration with Other Financial Tools

- Check for compatibility with your banking institution, financial software, or investment platforms to ensure seamless data synchronization.

Community and Learning Resources

- Evaluate the availability of educational content and user communities that can support your journey toward financial literacy and mastery.

Customization and Flexibility

- Assess the level of customization each app affords, from personalized spending categories to tailored budgeting goals for different periods.

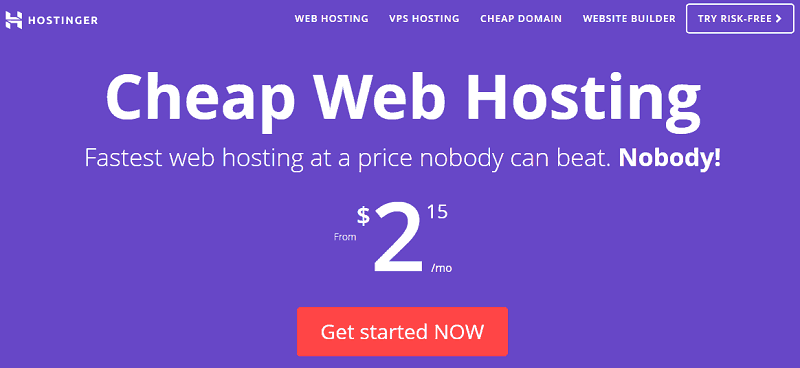

Crunching the Numbers – Free or Paid, and Is It Worth It?

Budgeting app users typically fall into one of two categories – those content with the offerings of free versions and those willing to invest in premium features. It’s essential to weigh the benefits against the costs to determine your ROI.

The Value Proposition of Free Versions

- Assess what features are available in the free iterations and whether they suffice for your immediate needs and long-term projections.

Investigating Paid Features

- Home in on the premium features offered by each app and consider how they may elevate your financial management experience.

Trial Period Utilization

- Take advantage of trial periods to test the full suite of features and determine if the paid version justifies the expense.

Cost-Benefit Analysis

- Conduct a rigorous cost-benefit analysis to understand if the investment in a budgeting app aligns with your savings or revenue generation tactics.

The Final Review – Success Stories and User Feedback

Lastly, before committing to your budgeting app of choice, it’s beneficial to survey the success stories of users with similar profiles to yours and to glean insights from peer reviews.

User Testimonials and Case Studies

- Find and digest comprehensive user testimonials and case studies detailing how each app has transformed the financial lives of its users.

Sift Through App Store Ratings and Reviews

- Navigate the labyrinth of app store ratings and reviews to uncover trends, both positive and negative, among the user base.

Reach Out to User Communities

- Engage with user communities and forums to gain insider perspectives on the real-world efficacy of these budgeting applications.

Consider the Long-Term Prospects

- Envision how each budgeting app can factor into your long-term financial growth or business scalability, and weigh this against short-term convenience.

Conclusion – Budgeting in the Digital Era

Budgeting in the digital era is not merely about balancing the books; it’s a dynamic process that can fuel personal empowerment and business success. By following this ultimate budgeting blueprint, you are equipped to select the app that seamlessly integrates with your lifestyle or business operations, setting you on the path to financial triumph.

Armed with the right budgeting app, you can turn the tide on your financial health and usher in a new age of frugality, intelligence, and prosperity. It’s not just an app – it’s a partner in your financial ascent. Choose wisely, and budget boldly!