Choosing the right trading platforms is a key first step for beginners interested in joining proprietary trading firms. The best platforms for newcomers are those that offer an intuitive interface, strong support resources, and seamless access to essential trading tools. New traders often benefit from solutions that simplify order execution and risk management, which can make starting a trading career less intimidating.

Many proprietary trading firms, such as Atmos Funded Forex prop firm or day trading firms, cater to beginners by providing funded accounts, step-by-step challenges, and educational resources tailored for those just starting out. For those new to prop trading, evaluating the available features, community support, and profit-sharing opportunities in beginner-friendly trading platforms can make a significant difference in overall experience and results.

Table of Contents

Key Takeaways

- Beginner-friendly trading platforms are essential for those starting with prop trading firms.

- Look for platforms offering intuitive design and supportive features.

- Funding opportunities and educational support can boost a beginner’s trading career.

Key Features of Beginner-Friendly Trading Platforms for Prop Firm Traders

Beginner traders joining prop trading firms need intuitive platforms, supportive learning environments, and opportunities to practice before trading with real capital. The right trading platform should lower barriers to entry and help new traders manage risk, execute their trading strategies, and develop core trading skills.

User Interface and Ease of Use

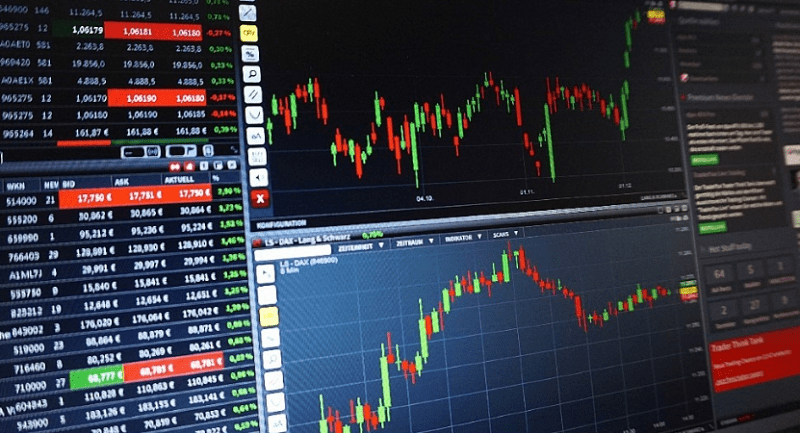

A user-friendly interface is essential for beginners navigating prop trading for the first time. Trading platforms designed for new users tend to offer simple layouts, clear navigation, and customizable dashboard features. This helps traders quickly access charts, orders, and analytical tools without confusion.

Visual clarity supports decision-making in fast-moving markets. Easy-to-read charting tools and real-time data feeds allow users to track market movements, apply technical analysis, and follow their trading plan efficiently. Immediate access to functions such as stop-loss, take-profit, and account monitoring enables strict adherence to risk management rules. For beginners, platforms that limit complexity let them focus on strategy and learning, rather than struggling with advanced tools prematurely.

Educational Resources and Training Support

Strong educational support separates leading trading platforms from their competition. Beginners benefit from platforms that offer structured learning, covering topics such as trading strategies, financial instruments, and market analysis. Prop trading firm partners often provide comprehensive training, mentorship programs, and a blend of self-paced modules and live webinars. Interactive guides, video tutorials, and regular updates on market conditions help develop trading skills incrementally.

Customer support that is responsive and knowledgeable is vital for addressing technical issues, explaining platform features, and reinforcing good risk management habits. For those new to trading, access to a supportive learning environment can significantly boost confidence and reduce costly mistakes.

Account Types and Demo Accounts for Practice

Beginner-friendly trading platforms feature a range of trading accounts, including demo accounts that use virtual funds. Practicing with demo accounts allows traders to familiarize themselves with platform features, test new trading strategies, and refine their approach without risking capital or exceeding drawdown limits. Demo trading not only builds confidence but also teaches effective risk management and adapts users to different market conditions. Some leading prop trading firms offer tiered account sizes and scaling options, encouraging gradual progression from practice to a real, funded trading account.

Look for platforms with seamless transitions between demo and live trading environments. The best beginner options offer transparent funding rules, low minimum deposit requirements, and risk management tools that help enforce low-risk trading—maximizing the potential for traders to pass firm evaluations and access funded accounts.

Best Trading Platforms for Beginners Joining Prop Firms

Selecting the right trading platform is crucial for beginners who want to join a reputable prop trading firm. Ease of use, access to advanced tools, and support for multiple asset classes help new traders navigate the evaluation process and maximize the profit share available from funded accounts.

cTrader for Enhanced Functionality

cTrader is gaining popularity with funded traders for its modern user interface and advanced analytical tools. It provides lightning-fast order execution, making it suitable for active trading strategies favored by prop firms like E8 and FundedNext. The platform offers depth of market (DOM) functionality, tick charts, and multiple order types, which help traders better understand liquidity and market conditions. cTrader allows customized layouts, detailed trade analytics, and supports automated trading through cTrader Automate using C#.

For beginners, cTrader’s learning curve is relatively gentle, especially for those transitioning from MT4/MT5. Comprehensive educational materials are available, and many prop trading firms, particularly those focused on forex trading and larger capital, are integrating cTrader for enhanced transparency and advanced trading technology.

NinjaTrader and Trading Stocks or Futures

NinjaTrader is a leading choice for new traders interested in stocks and futures. The platform’s focus on extensive backtesting and simulation lets beginners refine strategies before risking real capital during a trading combine or challenge. NinjaTrader offers instant funding features through selected partners and supports scaling plans to accommodate growing trading capital.

Its community is active and helpful, providing guidance on the platform and markets. Many beginner-friendly prop firms recommend NinjaTrader, particularly for those seeking real-world experience with financial institutions and aiming to participate in profit-sharing or profit split programs.

Conclusion

For beginners entering prop trading, selecting a trading platform with simple navigation, stable performance, and educational support is key. Many well-known prop firms now offer platforms that feature easy onboarding and demo environments, making it possible to practice with minimal risk.

Platforms that stand out for new traders often include benefits like clear evaluation rules, responsive customer support, and compatibility with major trading tools. Leading firms typically emphasize transparency, fair trading conditions, and accessible profit splits, helping beginners build confidence step by step.