When financial burdens begin to pile up, it’s natural to feel overwhelmed. Rising debt, missed payments, and pressure from creditors can leave you emotionally drained and uncertain about what to do next. In such a fragile state, it’s hard to know which option is best, and making the wrong choice can have lasting consequences.

Many people hesitate to file for bankruptcy out of fear. They believe it means losing everything, ruining their credit, or that they’ll never be able to rebuild their credit. These misconceptions can prevent individuals from seeking the help they truly need, forcing them deeper into financial distress.

The reality is that bankruptcy, though complex, is a legal solution to help people regain financial control. With the right legal advice, you can make informed decisions, protect your assets, and start fresh. A bankruptcy lawyer can help you understand your legal options, handle the paperwork, and guide you through the process with reliable support.

Table of Contents

Top signs it’s time to call a bankruptcy lawyer

Financial situation is too complicated, and your assets are at risk

If your finances feel like they’re getting out of control, especially if you’re running a business with several loans, unpaid bills, and too many creditors, it may be time to seek legal help. Managing everything at once becomes harder when debts pile up and cash flow slows down.

When you start missing payments to creditors, things can go downhill quickly. You might be forced to sell your property or other valuable assets just to keep up. If you’ve reached this stage, it’s a strong sign that you need a bankruptcy lawyer. They can help you understand your legal options, protect your assets, and take the right steps before things get worse.

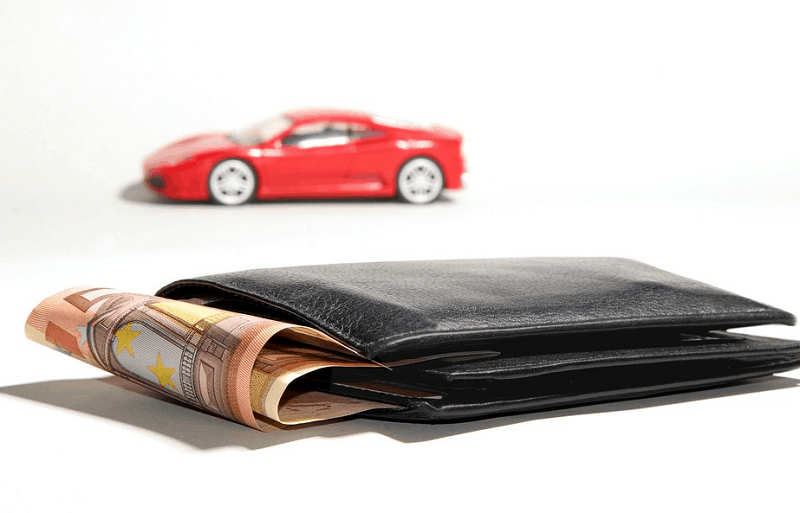

Facing foreclosure or repossession

If you’ve fallen behind on loan payments, whether it’s a mortgage, vehicle loan, or other secured debt, you may be at risk of foreclosure or repossession. Lenders can begin legal action to claim or seize the property you used as collateral, such as your home, car, or business equipment.

Filing for bankruptcy can help by placing an automatic stay on these actions, which temporarily halts foreclosure or repossession. A bankruptcy lawyer can guide you through this process, helping you understand your rights and find legal ways to keep important assets while managing your debt.

Not sure which type of bankruptcy to file

Bankruptcy can offer relief, but choosing the right type, Chapter 7, Chapter 13, or another option, depends on your specific situation. Each comes with its own rules about eligibility, repayment, and asset protection. Making the wrong choice could lead to unnecessary loss of property or a longer, more difficult legal process.

If your financial situation includes both personal and business debt, things can get even more complicated. A bankruptcy lawyer can clearly explain the differences, help you avoid mistakes, and guide you toward the option that best fits your needs.

You’re getting constant threat calls or messages from creditors

When you owe money, it’s common to get calls or messages from creditors. But if they keep calling you every day, send frequent letters, or speak to you in a rude or threatening way, it can be too much to handle.

This kind of constant pressure is a sign that you may need a bankruptcy lawyer. They can help stop the harassment you receive and explain what you can do next. Once you file for bankruptcy, debt collectors are legally required to stop threatening you. This gives you a break from the constant pressure and allows you to focus on getting your finances back on track.

Conclusion

If you’re seeing any of these signs in your life, growing debt, threats of foreclosure, confusion about bankruptcy types, or constant calls from debt collectors, it’s time to consider talking to a bankruptcy lawyer. You don’t have to wait until things hit rock bottom. Getting legal help early can prevent the situation from getting worse and give you a path toward financial relief.