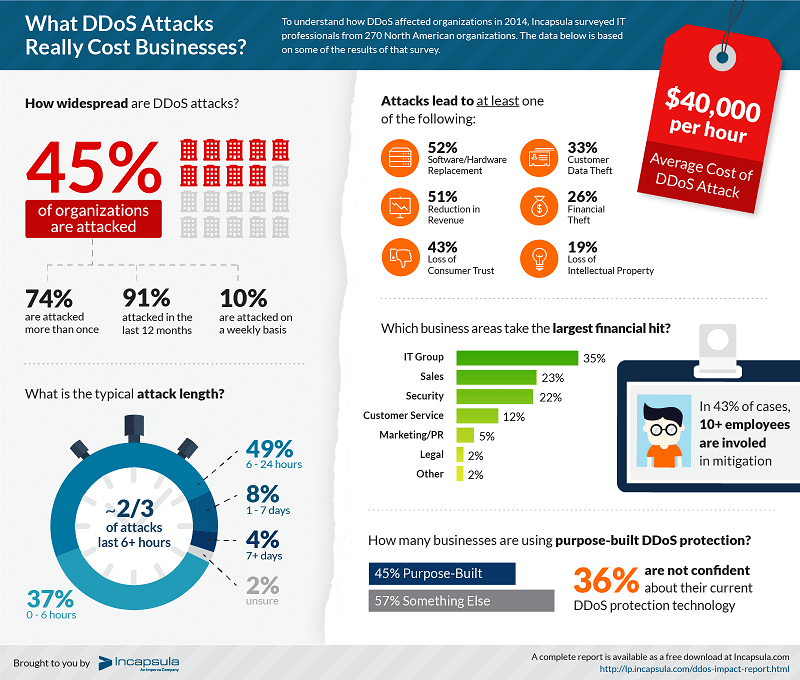

Investment fraud is a growing concern in Ohio, with residents losing over $150 million to various scams in 2023, according to the Federal Trade Commission. The FBI’s Internet Crime Complaint Center received 17,864 complaints from Ohioans that year, ranking the state fifth nationwide for Internet crimes. Notably, investment fraud was the costliest cybercrime, accounting for $4.57 billion in losses across the U.S. In Ohio, cases like the $72 million scheme involving certain financial managers and the $8.6 million fraud by a Southwest Ohio man highlight the severity of the issue.

To protect your investments with an Ohio securities fraud attorney, it’s crucial to seek experienced legal counsel. An attorney specializing in securities fraud can help you navigate the complexities of your case, gather necessary evidence, and pursue justice against those who have misused your trust and finances. By taking prompt legal action, you can work towards recovering your losses and safeguarding your financial future.

Table of Contents

What Is Securities Fraud?

Securities fraud refers to the practice of deceiving people in the stock or commodities market. This involves spreading misinformation, indulging in insider trading, or creating Ponzi schemes. This kind of fraud can have dire effects on an investor’s portfolio. Early identification of these scams is the key to safeguarding your financial interests.

What Does a Securities Fraud Attorney Do?

A securities fraud attorney specializes in spotting and fighting fraudulent investment schemes. They know how to navigate complicated legal structures and protect investors’ rights. These attorneys identify irregularities, collect proof, and build compelling cases to seek justice against wrongdoers.

Select the Right Lawyer

Choosing a legal advisor is an important decision. Investors should look for lawyers with a history of success in securities fraud litigation. While experience and reputation don’t tell the whole story, client testimonials can help offer a glimpse into a lawyer’s ability. Trust and constant communication are significant in building a solid attorney-client relationship. Competent lawyers empower clients to handle their finances better.

Assessing the Situation

Prompt action is essential for indications of deception. A securities fraud attorney can review the situation and help determine if litigation is appropriate. They examine the damage due to fraud and recommend the best action. This insight is invaluable. Through this guidance, people can determine whether pursuing litigation or another resolution is in their best interest.

Building a Strong Case

Lawyers follow a detailed process for building an authentic case. They organize and examine evidence, question witnesses, and work with specialists. They try to prove that the fraud has affected their clients in a specific way. This thorough approach increases the chances of a positive outcome for defrauded investors.

Negotiating Settlements

Sometimes, litigation may be unnecessary. An experienced lawyer can settle your case and help you recover your losses without going to court. They use their knowledge and negotiation skills to get the best possible outcome for their clients.

Representation in Court

If litigation is inevitable, hire an experienced attorney to represent you. They advocate for you in court, present evidence, and deliver arguments to help you win. They know how courts work and ensure your case is well-organized and presented.

Prevention, Awareness, and Education

Securities fraud attorneys work to prevent fraud in addition to resolving existing fraud situations. They teach clients best practices for safe investing and help spot warning signs of fraud. This proactive strategy allows investors to avoid fraud in the future and invest in secure financial products or instruments.

Emotional Support

Loss is not just about losing money due to fraud. It can also be emotionally taxing, leading to a lot of stress and anxiety. Lawyers act as a support system; they provide reassurance in moments of great distress. Their determination to protect clients’ interests reduces the load of dealing with fraud-related problems.

Conclusion

It takes extensive effort to protect investments from fraud. A securities fraud attorney brings skill and guidance when it is essential and helps protect investor rights. Investors can protect their financial futures by learning about the warning signs of fraud and acting quickly. A qualified lawyer ensures that victims of securities fraud have reliable legal representation to fight for them with their best interests in mind.