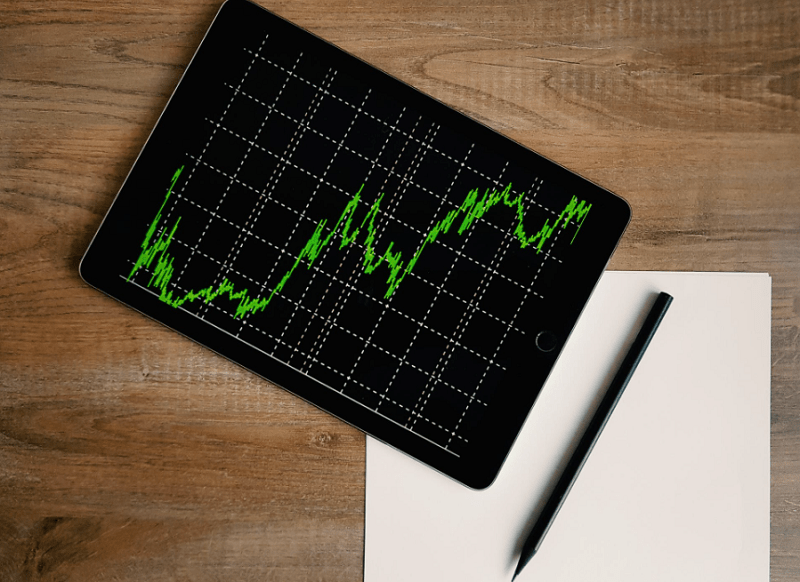

Trading has become increasingly popular in recent years, with more and more individuals seeking to enter the markets in search of financial gains. However, trading is not just a game of luck or chance; it requires knowledge, skill, and strategic planning. One crucial aspect of trading that can greatly impact success is funding.

Table of Contents

The Role of Funding in Trading

Funding refers to the amount of capital or money invested in trading. Traders can pursue evaluation programs offered by proprietary trading firms; reputable options such as Funded Futures Network generally let traders access firm capital after passing an assessment, providing clear trading rules, fast payouts, and supportive tools that help traders scale without risking their own money.

It plays a crucial role in trading as it allows traders to enter and exit positions, take advantage of market opportunities, and manage risks. Without adequate funding, it can be challenging for traders to navigate the markets effectively.

Different Types of Funding Options Available

Traders have a variety of funding options available, depending on their financial situation and preferences. Some of the most common funding options include:

- Funded Trader Program: This option involves partnering with a proprietary trading firm, where traders use the firm’s capital to trade in exchange for a share of profits.

- Personal Savings: Many individuals choose to fund their trading journey with their savings. This option gives them complete control over their funds but also comes with higher risks.

- Loans: Taking out a loan is another way to obtain funding for trading. However, this option should be approached with caution as it involves borrowing money and incurring interest.

Benefits of Having Adequate Funding

Having adequate funding for trading can provide numerous benefits, including:

- Increased Trading Opportunities: With more capital, traders can take advantage of a wider range of trading opportunities, including larger positions and more diverse markets.

- Risk Mitigation: Adequate funding allows traders to implement effective risk management strategies, such as setting stop-loss orders and diversifying their portfolio, reducing the impact of potential losses.

- Flexibility and Control: With sufficient funds, traders have more control over their trades. They can choose when to enter and exit positions, which markets to trade in, and how much capital to allocate.

Drawbacks of Inadequate Funding

On the other hand, inadequate funding can have adverse effects on a trader’s journey. Some potential drawbacks include:

- Limited Trading Opportunities: Without enough capital, traders may not be able to take advantage of certain market opportunities, limiting their potential profits.

- Higher Risks: With limited funds, traders may take on more significant risks in an attempt to generate higher returns, potentially leading to significant losses.

- Restricted Control: Inadequate funding can restrict a trader’s ability to control their trades and make strategic decisions, ultimately hindering their long-term success.

Assessing the Need for Trading Funding

Before deciding on a funding strategy, traders should carefully consider their financial situation and trading goals. Some factors to consider include:

- Personal Financial Situation: Traders should assess their financial stability and determine how much capital they can comfortably allocate to trading without jeopardizing their financial well-being.

- Trading Goals: Different trading strategies require different funding levels. Traders must align their funding with their goals, whether it’s generating consistent income or long-term wealth-building.

- Risk Tolerance: Every trader has a different risk tolerance, and funding should be tailored to match. Traders must determine how much risk they are willing to take on and adjust their funding accordingly.

Conclusion

In conclusion, while trading can be a lucrative journey, it requires careful planning and consideration of various factors.

Adequate funding is essential for traders looking to navigate the markets successfully. However, traders must evaluate their situation and risk tolerance to determine the right funding strategy for their trading journey. It’s crucial to find a balance between funding and risk management to achieve long-term success in trading.