When it comes to loans and credit cards, one question often confuses: Are credit score and CIBIL score the same? Many borrowers use the terms interchangeably, while others believe one matters more than the other. This mix-up often leads to myths that can affect borrowing decisions.

So, are credit score and CIBIL score the same? Understanding the difference is crucial because lenders rely heavily on these numbers to assess your financial reliability. By understanding the meaning of each term, you can avoid common misconceptions and take control of your credit journey.

Table of Contents

Credit Score vs. CIBIL Score: What Sets Them Apart

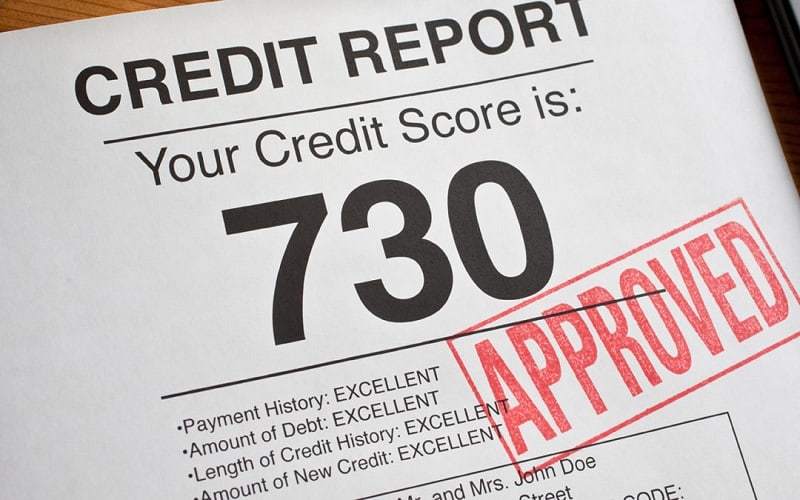

Lenders use a credit score as a quick snapshot of your financial reliability. It’s a three-digit figure built from your repayment record, debt levels, credit usage, and overall borrowing habits. This number helps banks and financial institutions decide how risky or safe it is to lend to you.

A CIBIL score, on the other hand, is the credit score generated by the Credit Information Bureau India Limited (CIBIL), one of the four licensed credit bureaus in India. The CIBIL score range runs from 300 to 900, with higher scores reflecting stronger credit health.

So, are credit score and CIBIL score the same? Not exactly. A credit score is a broad term, while a CIBIL score is one version of it. All CIBIL scores are credit scores, but not every credit score is provided by CIBIL.

Why People Mix up Credit Score and CIBIL Score

Many borrowers use the terms interchangeably because both point to the same idea, measuring financial reliability. Over time, the phrase “CIBIL score” became so common in everyday use that people assumed it was the only form of credit score.

This mix-up often leads to the question: are credit score and CIBIL score the same? The answer is no. A credit score is the broader concept, while a CIBIL score is one type of it. Knowing the difference helps borrowers avoid confusion and manage their credit profile more effectively.

CIBIL Score Range and What it Means

The higher your score within this range, the more financially reliable you appear to lenders.

- Scores at the lower end typically indicate a high risk.

- Mid-range scores show average reliability and may still get approvals with stricter terms.

- Scores toward the top reflect strong repayment discipline, increasing the chances of quick approvals with better loan terms.

Understanding where you fall in the CIBIL score range helps you plan better. It tells you whether to apply for credit now or wait until your profile is stronger.

Why the Difference Matters for Borrowers

Understanding the difference between a credit score and a CIBIL score can significantly impact your borrowing journey. When you ask yourself, Are credit score and CIBIL score the same, the answer shapes how you prepare for loans.

If you rely only on one type of score, you may overlook how lenders assess your overall credit profile. A broader view ensures gaps or errors in your report don’t catch you off guard.

Awareness of the CIBIL score range also gives you a benchmark. It helps you understand whether you should apply now or wait until your profile is stronger. This knowledge reduces rejection risks and helps you qualify for better loan terms.

5 Common Myths About Credit Score and CIBIL Score

Confusion between credit score and CIBIL score has given rise to several myths that can mislead borrowers. Let’s clear up some of the most common ones:

- Credit Score and CIBIL Score are Identical

This is the most common misconception. Borrowers often ask, Are credit score and CIBIL score the same? A credit score is the general concept, while a CIBIL score is one version of it. Treating them as identical oversimplifies the system’s actual operation.

- Only CIBIL Scores are Accepted by Lenders

While the term “CIBIL score” is widely used, lenders can assess your creditworthiness through different types of scores. A credit score is not limited to just one source.

- The CIBIL Score Range is Completely Different From Other Scores

The CIBIL score range of 300 to 900 follows the same broad structure used by other scoring models. The interpretation may vary, but the range itself is not unique.

- Checking your Score Frequently Lowers It

Many borrowers avoid checking their credit information out of fear that it will drop. In reality, a personal credit score check is considered a “soft inquiry” and does not harm your score.

- A Good Score Guarantees Loan Approval

A strong position in the CIBIL score range increases your chances, but lenders also consider other factors like income stability, existing debts, and repayment capacity before making a decision.

Busting these myths helps borrowers see the bigger picture. Understanding the real difference between a credit score and a CIBIL score allows you to make informed decisions instead of relying on assumptions.

How to Maintain a Strong Credit and CIBIL Score?

Improving your score isn’t just about following a checklist; it’s about developing consistency in how you manage your finances. Borrowers often wonder if a credit score and a CIBIL score are the same. Regardless of the term, the habits that keep you within a healthy CIBIL score range are built through consistent, long-term practices.

Here’s a fresher take on maintaining a strong profile:

- Build a steady repayment track record

- Balancing secured and unsecured credit

- Plan borrowing carefully

- Stay informed

These practices show discipline, which is the real foundation of a strong credit profile. Over time, they help you move upward within the CIBIL score range and improve your access to credit.

Why Understanding Credit Score vs CIBIL Score Strengthens Your Financial Journey

So, are credit score and CIBIL score the same? The answer is no. A credit score is the broader concept, while a CIBIL score is one version of it. Both play an important role because lenders may consider different reports before making a decision.

Understanding the CIBIL score range gives you a benchmark to work with and helps you prepare for borrowing with confidence. Staying aware of your profile ensures fewer surprises, stronger loan eligibility, and better terms. With platforms like Olyv, keeping track of your credit health becomes simple, reliable, and part of everyday financial planning.