When it comes to building and growing wealth, few people do it better than the richest person in the world. These billionaires have mastered investment strategies that not only preserve their wealth but also multiply it.

In this article, we’ll delve into the investment strategies employed by the wealthiest people on the planet and explore how they manage to continually grow their fortunes.

Table of Contents

Billionaire Investment Strategies

The strategies used by billionaires are often nuanced and sophisticated, reflecting their unique access to resources and opportunities. However, some common themes emerge when analyzing how these individuals approach investment.

Key Characteristics of Billionaire Investors

- Long-Term Vision: Billionaires tend to invest with a long-term perspective. They understand that significant wealth is often built over decades, not months or years.

- Diversification: Diversifying investments across different asset classes and geographic regions helps billionaires manage risk and seize opportunities in various markets.

- Innovation and Technology: Many of the richest individuals place a strong emphasis on investing in innovative technologies and disruptive industries.

- Private Equity and Venture Capital: Access to private equity and venture capital allows billionaires to invest in high-growth companies before they go public.

Diversification: A Pillar of Wealth Management

Diversification is a cornerstone of billionaire investment strategies. By spreading investments across various asset classes, billionaires mitigate risk and ensure that their wealth is not tied to the performance of a single asset.

Asset Classes and Geographic Diversification

- Real Estate: Billionaires often invest in a range of real estate assets, from residential and commercial properties to luxury estates and agricultural land. Real estate provides a tangible asset that can appreciate over time and offer rental income.

- Equities: Investing in a broad portfolio of stocks helps billionaires capitalize on the growth of different industries and markets. They often hold shares in blue-chip companies, high-growth tech firms, and emerging markets.

- Fixed Income: Bonds and other fixed-income securities offer stability and predictable returns. Billionaires use these to balance their portfolios and generate steady income.

- Alternative Investments: Investments in hedge funds, private equity, and venture capital allow billionaires to access high-risk, high-reward opportunities that are not available to the general public.

Global Investments

Billionaires also diversify geographically to protect their wealth from regional economic downturns. By investing in different countries and currencies, they can take advantage of global growth opportunities and mitigate country-specific risks.

Embracing Innovation and Technology

The richest individuals often invest heavily in technology and innovation. This focus on future-oriented sectors is a common trait among “orang terkaya di dunia.”

Tech Startups and Disruptive Technologies

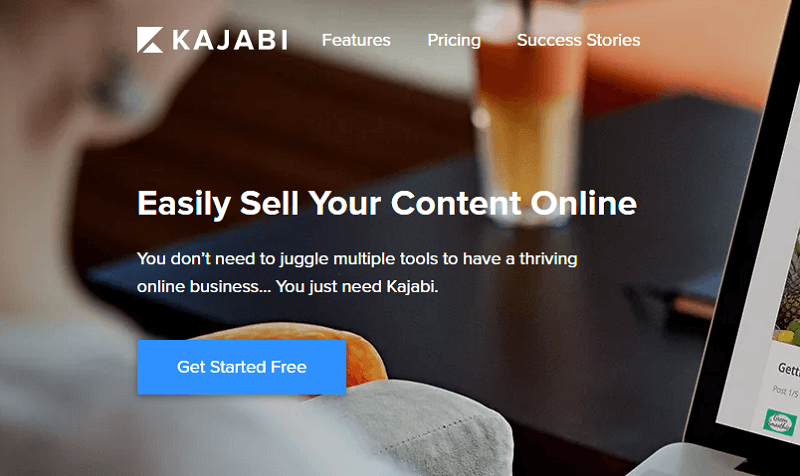

- Tech Startups: Billionaires frequently invest in tech startups that have the potential to disrupt existing markets or create entirely new ones. These investments can yield substantial returns if the startups achieve significant growth or become market leaders.

- Artificial Intelligence and Robotics: Investments in AI and robotics are becoming increasingly popular among billionaires. These technologies promise to revolutionize industries, offering substantial growth potential.

- Renewable Energy: With the global push towards sustainability, investments in renewable energy sources like solar and wind power are becoming more attractive. Billionaires recognize the long-term benefits of supporting green technologies.

Leveraging Private Equity and Venture Capital

Private equity and venture capital investments offer billionaires the opportunity to invest in companies at various stages of their development. These investments can lead to significant returns if the companies succeed.

Private Equity Investments

- Buyouts and Mergers: Billionaires often engage in buyouts and mergers of established companies, aiming to improve their operations and profitability before eventually selling them at a profit.

- Growth Capital: Providing growth capital to expanding companies allows billionaires to benefit from the company’s future growth and success.

Venture Capital Investments

- Early-Stage Funding: Investing in early-stage companies offers the chance to get in on the ground floor of potentially groundbreaking innovations. Although these investments carry higher risk, they can also lead to massive rewards.

- Series Funding: As companies grow, billionaires may participate in subsequent rounds of funding to maintain their stake and benefit from further growth.

The Role of Risk Management

Effective risk management is crucial in preserving and growing wealth. Billionaires employ various strategies to minimize risks and protect their investments.

Risk Mitigation Techniques

- Due Diligence: Thorough research and due diligence are essential before making any investment. Billionaires invest time and resources into understanding the potential risks and rewards associated with their investments.

- Hedging: Using financial instruments like options and futures to hedge against market fluctuations helps billionaires protect their portfolios from adverse movements.

- Professional Advisors: Many billionaires work with a team of financial advisors, legal experts, and industry specialists to ensure their investments are well-managed and aligned with their long-term goals.

Strategic Networking and Partnerships

Building relationships and strategic partnerships is another important aspect of billionaire investment strategies. Networking with other successful investors, industry leaders, and experts provides valuable insights and opportunities.

Collaborative Investments

- Joint Ventures: Billionaires often enter into joint ventures with other investors or companies to share resources, knowledge, and risks.

- Investment Clubs: Some billionaires participate in exclusive investment clubs where they collaborate with peers to identify and pursue high-potential investment opportunities.

In conclusion, the investment strategies of the wealthiest individuals, or “orang terkaya di dunia,” reveal a sophisticated and multifaceted approach to wealth management. By focusing on diversification, embracing innovation, leveraging private equity and venture capital, and employing effective risk management techniques, billionaires are able to multiply their wealth and secure their financial futures. For aspiring investors, studying these strategies and adapting them to individual circumstances can provide valuable insights and opportunities for growth. Whether through strategic investments in technology, real estate, or global markets, understanding how the richest people manage their wealth can offer valuable lessons for achieving financial success.