Estate planning is among the tasks most people dread doing. However, it is a very important step you can take for your future and that of your loved ones. With the help of an estate planning attorney, you can create a solid estate plan that ensures that your wishes are carried out, assets are protected, and your loved ones are not left guessing during a difficult time.

But where do you even start? Well, estate planning attorneys from Southern Estate Lawyers can walk you through the process to ensure you are well set up. Even if you have a modest estate, the right plan can make all the difference. Here is an overview of how to create an estate plan that fits your situation.

Table of Contents

1. Start by Taking Inventory of What You Own

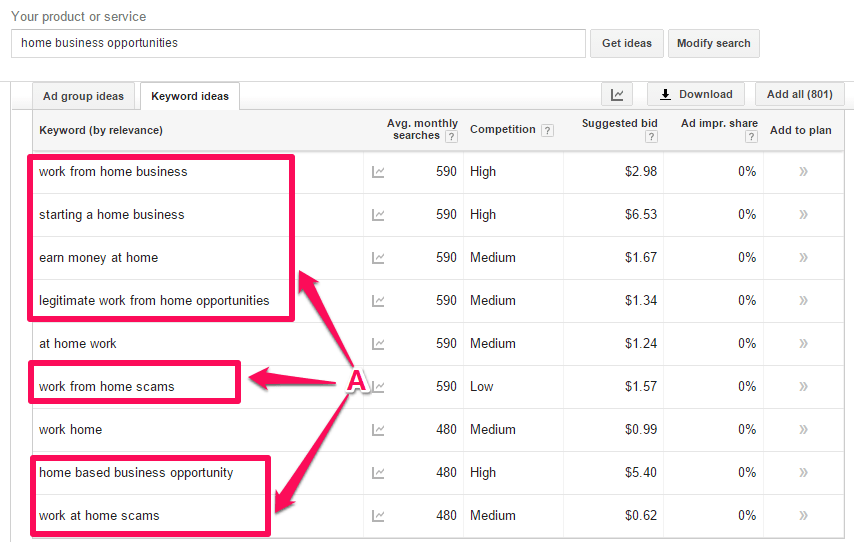

Before you can plan what to do with your estate, you need to know what is in it. Start by listing all your assets, including your:

- Home

- Vehicles

- Bank accounts

- Retirement savings

- Investments

- Business

- Valuable personal items like jewelry and collectibles

Also, include your digital assets, like online accounts or cryptocurrency. Additionally, it is a good idea to note down your debts, such as mortgages, loans, and credit card balances. This will give you a clear picture of what your estate plan needs to address.

2. Choose the Right People for Key Roles

An effective estate plan relies on responsible people to carry out your wishes. You will need to choose an executor. This is someone you trust to manage your estate and handle tasks like paying debts or distributing assets.

Next, appoint a power of attorney who will manage financial matters if you become unable to do so yourself. Also, choose a healthcare proxy to make medical decisions on your behalf. There are decisions you should not take lightly. Pick people who are reliable, honest, and capable of making tough decisions.

3. Put the Right Legal Documents in Place

You will need a will to state how you want to distribute your assets. A will can also name guardians for minor children. You may also want a living will, also known as an advance healthcare directive, which details your wishes for medical care in the event you can’t speak for yourself.

For more complex estates, setting up a trust can offer added benefits like protecting assets for future generations. Whatever your needs are, working with an estate planning attorney will help ensure everything is handled in the proper legal way.

4. Consider Taxes and Probate

Estate taxes might not affect everyone, but if your estate is large enough, it could take a significant bite out of what you left behind. Estate taxes range between 18% and 40% if your assets have a fair market value of $13.99 million or more.

A trust can help in reducing tax burdens and simplifying the process for your heirs. Additionally, proper planning, like naming beneficiaries on retirement accounts and life insurance policies, can also help your estate avoid a lengthy and public probate.

Conclusion

As you create your estate plan, remember to revisit it often and make changes. Things like marriage, divorce, financial ups and downs, or new family additions need to be factored in to ensure your plan remains effective.