Investing in the stock market can be a daunting task, especially for beginners. With so many companies and stocks to choose from, it can be overwhelming to know where to start. That’s where stock research platforms come in – they provide valuable information and tools that can help investors make informed decisions about which stocks to buy or sell. But with so many options available, how do you choose the best stock research platform for your needs? In this guide, we will discuss the key factors to consider when selecting a stock research platform.

Table of Contents

Types of Stock Research Platforms

Stock research platforms like Simply Wall St, Morningstar, and Zacks Investment Research are all excellent resources for investors. However, each platform offers different features and benefits.

Some popular types include:

- Online brokers: These platforms not only offer the ability to research stocks but also allow users to buy and sell stocks directly through their platform.

- Financial news websites: These platforms provide articles, analysis, and market news that can help investors stay up-to-date on market trends and make informed decisions.

- Stock screeners: These tools allow users to filter stocks based on specific criteria such as price, market cap, and industry.

- Research websites: These platforms provide in-depth information on individual stocks, including financial data, analyst reports, and company news.

Key Factors to Consider

When choosing the best stock research platform for your needs, there are a few key factors to consider:

1. Cost

Some stock research platforms are free while others charge a subscription fee. Before making a decision, consider how much you are willing to pay for the platform’s features and tools. Keep in mind that some platforms may offer a free version with limited features, while others may offer a free trial period.

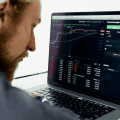

2. User-Friendly Interface

A stock research platform should be easy to navigate and user-friendly, especially for beginners. Look for platforms with a clean and organized interface that allows you to quickly find the information you need.

3. Tools and Features

Different platforms offer different tools and features, so it’s important to consider which ones are most important to you. Some common features include real-time market data, stock charts, analyst ratings, and financial statements.

4. Research Resources

The quality and quantity of research resources available on a platform can greatly impact your investing decisions. Look for platforms that provide reliable and comprehensive information such as company financials, analyst reports, and news articles.

5. Mobile Accessibility

In today’s fast-paced world, having access to your stock research platform through a mobile app can be extremely convenient. Some platforms offer mobile apps with all the same features as their desktop version, while others may have limited capabilities.

6. Customer Support

When using a stock research platform, you may encounter technical issues or have questions that need to be addressed. It’s important to choose a platform with good customer support options such as live chat, email, or phone support.

Conclusion

Choosing the best stock research platform for your needs can greatly improve your investing experience. Consider the type of platform, cost, user interface, tools and features, research resources, mobile accessibility, and customer support when making your decision. It’s also important to try out different platforms to see which one best suits your needs and investing style. With the right stock research platform at your disposal, you’ll be better equipped to make informed decisions and achieve your financial goals in the stock market.